Banking in 1926 A Difficult Year—Rise in Deposits—Loan Activities By

ARTHUR W. KIDDY.

Ir is impossible to study the reports and balance-sheets of the joint stock banks in modern times without being impressed by the Continued abnormality of post-War conditions. The maintenance of profits and dividends, a moderate rise in deposits, and a considerable expansion in loans might, under ordinary conditions, be regarded as reflecting Uot only prosperity in banking, but Fos- perity in the country itself. Time was when almost a cursory glance at the general trend of banking figures was sufficient to show the general trend of economic and financial developments, so far at all events as domestic conditions were concerned. To-day, however, it is necessary to look far more deeply into the inwardness of the figures before attempting to come to any definite conclusion as to the financial and business conditions which they reflect. Ir is impossible to study the reports and balance-sheets of the joint stock banks in modern times without being impressed by the Continued abnormality of post-War conditions. The maintenance of profits and dividends, a moderate rise in deposits, and a considerable expansion in loans might, under ordinary conditions, be regarded as reflecting Uot only prosperity in banking, but Fos- perity in the country itself. Time was when almost a cursory glance at the general trend of banking figures was sufficient to show the general trend of economic and financial developments, so far at all events as domestic conditions were concerned. To-day, however, it is necessary to look far more deeply into the inwardness of the figures before attempting to come to any definite conclusion as to the financial and business conditions which they reflect.

In any articles concerning the banking position it is necessary to present a good many figures showing move- ments for the year in deposits, loans, cash holdingS, investments, &c., but I want, if I .can, in this article to get beyond the dry bones of statistics and to show in simple fashion the connexion between these dry banking figures and the developments of the past year, not only as regards business activities but as regards the affairs of all sections of the community. For those who have eyes to sec can learn a great many things from these banking figures besides the position of the banks themselves, and, if I may be forgiven for writing in an organ like the Spectator in an unusually elementary fashion, I will try to show a few of the conditions and develop- ments which I think the roost recent reports and balance- sheets of banks disclose. Before doing so, however, and by way of furnishing a key to some of the principal movements in the banks' figures, let me recall some of the main features of the year with which the figures arc concerned.

INDUSTRIAL TROUBLES.

At the beginning of 1926 there were not wanting signs of An improvement in the industrial outlook, and evidenCe Of that improvement was afforded in many directions, including railway traffic receipts, which, for the first four months, showed in the aggregate an increase of over £1,000,000. By the beginning of April, however, the situation was affected by apprehensions with regard to the coal dispute, and at the beginning of May the storm broke and Great Britain for the first time in her history experienced a general strike. The nation came out of that ordeal well, but it was destined to suffer the further strain of an eight months' coal stoppage, and the damage inflicted by that crisis upon all industries was well shown in a recent issue of the Ministry of Labour Gazeue. Even in the year 1925 the number of working days lost by industrial disputes was 7,966,000, but last Year the figure was 162,784,000, of which about 1,47,°00,000 was contributed by the coal stoppage and about 15,000,000 by the -general strike. Ong returns of foreign trade were, apart from the War period, the worst on record, while railway receipts closed the year with a loss of not far from £80,000,000. In a subsequent article* I shall be dealing with the *Th; '8 artielt appears_in the_gcneral columnssof the current issue on PaIA, 390. banking year from the standpoint of profits to share- holders, but it may not be out of place to state just here what is meant when the past year and present conditions are referred to as being trying for bankers. In a sense, of course, each year brings its particular difficulties. In times of intense trade depression there is often the difficulty of employing funds profitably, while there arc many weak positions which have to be 'aided. On the other hand, when there is excessive trade activity or excessive speculation in securities, the difficulties arc of another kind which will easily occur to the intelligent reader, and in such periods high profits are not infre- quently- offset by considerable losses. On the whole, therefore, it might, perhaps, be said that the ideal con- ditions for the banker consist in a healthy trade activity, And especially an activity in our export trade, thus giving the banker the comfortable feeling. of assurance that his loans are being used in -producing economic conditions favourable to the country as a whole.

It EDEL3IING FEAT UR Eq.

These, however, were most assuredly not the conditions characterizing the past year, and there can be little doubt that 1926 would have been an even more trying year in banking and money market circles but for certain re- deeming points in the situation. In the first place there is no doubt that at the moment when economic conditions were adversely affected by. the. general strike and coal stoppage, the effect upon the foreign exchanges was very largely offset by our having returned to the gold standard, thus occasioning a general confidence on the part of foreign countries in our currency and financial position. It so happened, too, that the retention of our 5 per cent. Bank Rate, which became necessary as a consequence of the coal stoppage, was accompanied by a general down- ward tendency in money rates on the Continent, so that there was a strong impelling force making for the re- mittance of foreign balances here to earn interest. Mord- over, owing to the slump in the franc during the early part of the year this remittance of funds to this country obtained a still further impetus. Finally, and before noting the reflection of the past year's conditions in the banking figures, it may be noted that while there was inactivity and depression in our key industries there was a great deal of business doing in finance and on the Stock Exchange.

DEPOSITS II ER.

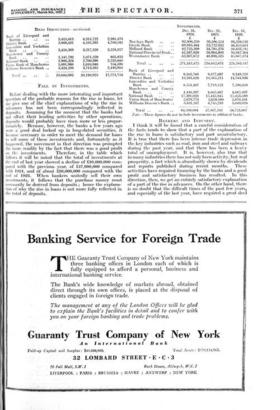

One of the first points to be noted in the figures shown -in the banks' balance-sheets is the upward tendency in ,deposits, this being the more noteworthy because for some years previously the tendency had been downwards. So far as the " Big Five " arc concerned, there was, for example, at the end of 1924 a decline of about £11,000,000, and at the end of 1925 a further fall of about £8,000,000. This year, however, there is an advance of no less than £51,000,000, against which the aggregate decline in the case of the provincial banks was only about £6,000,000. As usual, the cash in hand increased considerably, though it will be seen from the,following tables, and for the reason which will appear later, that so far as the " Big Five " were concerned the actual proportion of cash to liabilities was slightly below the level of the two preceding years :-

DEPOSITS.

Dee. 31, 1926.

£ 309,883,691 346,132,523 366,423,103 259,249,807 285,406,068 1,567,095,192 59,819,326 52,321,532 23,660,581 19,248,593 36,814,913 17,434,522 32,438,363 241,737,830 CASH IN HAND AND AT BANK OF ENGLAND.

Dee. 31, 1924.

£ • Dec. 31, 1925. Dec. 31, .

1926. • Barclays Bank .. 45,997,586 45,672,882 45,105,729 Lloyds Bank .. 42,005,032 39,401,271 42,998,320 Midland Bank . 50,876,592 53,590,604 52,994,044 National Provincial Bank.. 30,920,371 28,472,434 28,528,200 Westminster Bank 34,185,041 31,687,095 31,705,333 Total .. 203,984,622 198,824,286 201,331,626 Bank of Liv'erpool and

Martins . 7,781,370 7,252,886 5,961,008 District Bank 9,335,374 7,997,847 7,791,947 Lancashire and Yorkshire

Bank .. *5,422,289 '5,211,803 *5,135,167 Manchester and County

Bank - *4,320,158 *3,978,857 *3,782,687 National Bank 4,642,141 4,072,378 4,023,990 Union Bank of Manchester *1.710,381 *2,608,341 '3,478,419 Williams Deacon's Bank .. 4,330,282 4,071,011 4,117,835 Total .. .. • .. 37,541,995 . 35,193,123 34,291;053

• Including money at call and short notice. PROPORTION or CASH IN HAND AND AT BANK OF E NCLAND TO DEPOSITS.

Barclays Bank Lloyds Bank .. Midland Bank ..

National Provincial Bank Westminster Bank ..

Total Bank of Liverpool and Martins District Bank .. . • Lancashire and Yorkshire Bank Manchester and County Bank National Bank Union Bank of Manchester Williams Deacon's Bank ..

Total ..

• • • • • • • • •

..

• •

Dee. 31, 1924. 0/ 15.2 12.4 14.3 12.2 12.6 Dee. 31, 1925.

/0 14.9 11;7 15.4 11.3 11.7 Dee. 31, 1926. 0, o 14 .6 12.4 14.5 11.0 11.1 12.8 13.4 13.1 12.7 17.0 21.3 20.6 11.7 9.1 12.4 14.7 12.1 14.8 20.9 19.7 10.9 14.2 12.4 10.0 14.9 21.7 19.7 10.9 20.0 12.7 14.2 14.2

MON CV AT CALL AND SHORT NOTICE.

• Barclays Bank Lloyds Bank _ Midland Bank ..

National Provincial Bank .. Westminster Bank Dee. 31, 1924.

20,347,095 21,913,353 16,926,145 15,997,118 23,399,849

Dcc. 31,

1925.

19,864,335 *507,062 18,679,349 18,358,868 28,301,235 Dec. 31, 1926.

£ - 21,284,818 16,458,305 22.786,851 18,769,651 27,370,851

Total.. • •

98,583,560

.105,710,849-

106,674:476

Bank of Liverpool and

Martins 3,606,664 4,741,132 5,826,728 District Bank 4,-782,240 5,331,3430 4,590,420 'Lancashire and Yorkshire - -

Manchester and County

Bank ..

National Bank *3,613,336 *4,183,195 *4,181,400 Union Bank of Manchester

Williams Deacon's Bank .. 3,514,495 2,985,794 2,957,233 Total .. 15,516,735 17,241,481 17,555,781 * Including Stock Exchange loans awl Treasury Bills.

Dec. 31, 1924.

1 Dec. 31, 1925.

£ Barclays Bank .. .. 301,026,825 306,259,816 Lloyds Bank .. .. :139,989,727 337,178,515 Midland Bank .. .. 355,774,872 348,682,134 National Provincial Bank.. 254,921,144 252,737,817 Westminster Bank .. 272,832,400 271,379,667 Total .. 1,524,544,968 1,516,237,949 Bunk of Liverpool and

Martins 61,290,020 59,819,627 District Bank 54,786,962 54;050,540 Lancashire and Yorkshire

Bank .. 25,509,563 24,990,776 Manchester and County

Bank .. 20,991,160 20,211,047 National Bank 39,512,415 37,371,727 Union Bank of Manchester 18,849,503 18,283,110 Williams Deacon's Bank .. 34,836,370 32,787,663 Total 2.55,766,993 247,514,490 EXPANSION IN LOANS.

It is when we come to examine banking activities in the matter of loans, &c., that it becomes necessary to diagnose the position a little more closely, and to try to discover how far the movements both in deposits and loans can be regarded as consistent with what is generally assumed to be the main feature of the past year-namelv, trade depression and unemployment. Moreover, it must not be forgotten that it is not merely during the past year that trade has been depressed, the dullness having extended over a considerable period. And yet we find that during last year the loans and advances of the " HI! Five " expanded by £41,000,000, against which the set- back in the loans of provincial banks was only about £2,700,000, while if the figures of loans at the end of last year are compared with those of 1928 it will be found that there is an increase of no less than £143,000,000. These arc really astonishing figures and call. for very careful consideration. Are we to suppose that all the talk about trade depression is a mere illusion and a sham ? Or is it a ease of assistance to depressed industries having been given on such a scale as to have occasioned a great expansion in loans, not for promoting trade activity, but merely for holding up weak positions ? Moreover, as if to make the puzzle still more perplexing, it may be noted that in spite of this increase of £143,000,000 in loans for the three years the increase in deposits for the three years is only about R31,000,000, whereas it is frequently asserted, and with truth, that an increase in loans tends to bring about a corresponding increase in deposits.

LOANS Barclays Bank ..

Lloyds Bank Midland Bank National Provincial Bank .. Westminster Bank AND ADVANCES.

Dec. 31, Dec. 31, 1924. 1925.

140,078,976 153,028,485 164,714,331 183,330,726 190,691,323 196,747,548 131,242,924 133,617,259 121,946,012 126,516,051 Total 748,673,566 793,240,069 Bank of Liverpool and

Mart ins . . 37,431,444 35,413,244 District Bank 24,048,403 25,555,233 Lancashire and Yorkshire

Bank 9,935,930 10,672,495 Manchester and County

Bank 12,980,265 13,017,569 National Bank .. 16,285,400 16,321,759 Union Bank of Manchesth 14;403,507 /3,047,953 Williams Deacon's Bank .. 18,683,878 18,295,020 Total 133,768,827 132,323,273

Arc EPTANCES, ENDORSEMENTS, &C.

Dec. 31, 1924; ' Dec. 31, 1925. Dee. II, 1926.

Barclays Bank .. 11,308,303 17,175,922

12,446.1111

Lloyds Bank .. 22,701,940 20,686,775 16,950,16' Midland Bank .. 39,203,319 35,747,790

37,065.445

"National Provincial Bank.. 12,948,372 10,02-5,151

9,166,82:

Westminster Bank 16,430,325 13,562,790 11,5x13,63[ Total 102,592,259 97,198,428

87,172.644 Bank of Liverpool and

• Martins 8,254.768 6,618,372

District Bank 2,486,752 2,035,112 899.4.1( Lancashire and Yorkshire

Bank • • 202,350 135,948

143,37,

Manchester and County Bank 664,071 574,419

337.8:4

National Bank 987 100,000

103,.2'81

Bank of Manchester .Union 1,287,714 917,&57

818361

Williams Deacon's Batik . 2,970,974

2,359,45!

1,800,915

Total .. • • • •

15,867,316 12,741,180

1006014

BILLS DISCOUNTED.

Dee. 31, 1924.

£

Barclays Bank • • 33,24%646

Lloyds Bank Midland Bank .. 43,00,956 - 50,818,762 National Provincial Bank .. 37,093,884 Westminster Bank 41,970,486 Total .. 207,022,734 191,421,420

Dec. 31, 1926. 155,454,795 194,757,519 200,459,993 142,190,259 141,741,479 834,60406

36,702,937 24,188,792

9,900,512

12,464,11g I 5,903,439 11,548.019 18,984,829

129,692,07

Dee. 31, 1925. £ 32,028,847 4h624,130 41,888,022 35,880,917 39,999,504

46,744.31; 35,100.60 40,406,456

a08,05

Dee, 31. 192a-

£

36.617.24 47,182,911 BILLS DISCOi:NTED--coatittued.

Bank of Liverpool and Martins .. District Bank Lancashire and Yorkshire

Bank .. • • . •

Manchester and County Bank - • • • • National Bank Union Bank of Manchester Williams Deacon's Bank Total 3,415,813 3,668,431 3,438,369 1,141,792 2,880,324 1,091,966 3,424,298 4,315,722 4,101,395 3,217,326 • 1,071,559 2,700,596 1,010,940 3,713,382 2,981,479 4,768,582 3,228,317 865,833 2,535,1348 754,596 2,440,903 • 19,060,993 20,130,920 17,574,758 FALL IN INVESTMENTS.

Before dealing with the more interesting and important question of the probable reasons for the rise in loans, let Me give one of the chief explanations of why the rise in advances has not been correspondingly reflected in deposits. Assuming for the moment that the banks had not offset their lending activities by other operations, deposits would probably have risen more or less propor- tionately. • Because, however, the banks a few years ago were a good deal locked up in long-dated securities, it became necessary in order to meet the demand for loans to sell some of these investments and, fortunately as it happened; the movement in that direction was prompted the more readily by the fact that there was a good profit on the investments. Therefore, in the table which follows it-Will be noted that the total of investments at the end of last year showed a decline of £10,000,000 com- pared with the previous year, of £47,000,000 compared with 1924, and of about £90,000,000 compared with the end of 1923. When bankers unitedly sell their own investments, it follows that the purchase money must necessarily be derived from deposits ; hence the explana- tion of why the rise in loans is not more fully reflected in the total of depositS. Barclays Bank .. Lloyds Bank

Midland Bank National Provincial Bank. . Westminster Bank

INVESTmESTS.

Dec. 31, 1924.

£

62,806,250 69,916,464 42,725,269 42,587,820 53,307,672 Dec. 31, 1925.

£

59,596,214 53,722,653 34,791,276 38,964,003 46,938,525 Dee. 31, 1926.

£

56,259,1136 46,455,051 :38,853,582 36,947,304 45,867,674

Total .. • •

271,343,475 234,012,671 224,383,547 Bank of Liverpool and

Martins .. 9,503,748 8,677,097 9,349,216 District Bank 16,381,628 14,565,211 14,544,830 Lancashire and Yorkshire

Bank 8,554,407 7,719,123 7,590,658 Manchester and County

Bank 4.448,397 4,065,897 4,065,897 National Bank 17.391,033 15,435,845 15,453,589 Union Bank of Manchester 2,678,774 2,659,160 2,670,101 Williams Deacon's Bank .. 5,631,107 4,745,249 5,049,670 Total .. .. 64,589,094 57,867,582 58,723,967

Note. —These figures do not include investments in affiliated banks.

BANKERS AND INDUSTRY.

I think it will be found that a careful consideration of the facts tends to show that a part of the explanation of the rise in loans is satisfactory and part unsatisfactory. It is true that there has been intense trade depression in the key industries such as coal, iron and steel and railways during the past year, and that there has been a heavy total of unemployment. It is, however, also true that in many industries there has not only been activity, but real prosperity, a fact which is abundantly shown by dividends and reports published during recent months. These activities have required financing by the banks and a good profit and satisfactory business has resulted. In this direction, then, we get an entirely satisfactory explanation of a part of the rise in advances. On the other hand, there is no doubt that the difficult times of the past few years, and especially of the last year, have required a great deal or judicious assistance by the banks, and indeed if ever the history of these times comes to be fully written it will be found that. the banks have stood by British industries. as Much as would have 1.3eeii the -case if they had been actual shareholders in such industries, as in the ease, for example, of some of the German .banks. Indeed, it 'speaks well for sound management and fore- thought that these varying needs should have been met at a cost of less than one-hall' of 'one per cent. in the pro- portion of cash-to liabilities.

OVERDRAFTS.

Moreover, we know from no less an authority than Mr. Beaumont Pease, of -Lloyds Bank; that the private individual, including the professional man, is inaking an increasing use of the system of overdrafts, so that in the case of that one bank alone it was shown the other day that out of a total of a little over l'75,000,000 in overdrafts in three groups, 1:43,500,000 applied to personal and pro- fessional 'people. .Then, again, It must be remembered that during the past year loans to municipalities have probably been unusually extensive, owing to the fact that those in the mining' districts must have had heavy demands made upon them in connexion with the maintenance of families out of employment through the coc stoppage. Finally, there is little doubt that a further explanation of expan- sion in bankers' loans is to be found in the increasing activity and upward trend of prices of public securities, in connexion with which loans to the Stock -Exchange or loans to the public upon securities are now probably fairly large.

Previous page

Previous page