Bankers' Loans and Life Assurance

A Suggestion bbcrestion Ax actuary informed the writer that of 2,000 surrender value quotations made during the course of a year, 75 per cent. were quoted to Banks in respect of policies deposited with them as security for loans. A Life Policy is probably considered the best security for an overdraft or short loan, and as a collateral security is unequalled, the value increasing as each premium is paid, or if premiums are paid up it improves as the Assured gets rider.

It is interesting to note that so many people would rather obtain accommodation from their Bankers barked by a Life Policy than apply for a loan direct from the Life Office, possibly because it is imagined that the prOcedure in the latter case is more involved and protracted, or that the loan will only be a tem- porary matter. However, the object of this note is to (fired the attention of Bankers to the expedient of per- suading all borrowers to cover loans by a collateral Life Policy for the term of the loan. Where Bankers are agents of the Life Office they thus serve all interests and their own in particular. Loans have the effect of depleting capital on balance, and a loan on a Life Policy is a charge on the sum assured, and in the event of death the family provision afforded is reduced. to the extent of the loan. This provision should immediately be brought up to its par value by a further insurance over the time the loan is likely to be outstanding. The writer's- attention was drawn to a clause in an American Life Policy not found in British Life Policies, which illustrates the point in question. It reads :- EXTRACT FROM POLICY OF AN AMERICAN LIFE OFFICE. PRIVILEGES (SECTION .4)—TERM INSURANCE IN CASE OF

LOAN.

Any loan under this Policy may be covered by term insurance as follows :-

1. The Insured must furnish evidence of insurability satisfactory to the Company. 2. The premium shall be computed at the attained age of the 11'1Mtred at the time the term insurance is made or renewed. :1. Term insurance shall not extend beyond the next anniversary,

hut may under the same conditions he r..newed from year to yeak No term insurance shall be made or renewed after age ' 4. If the term insurance exceeds the indebtedness, the Company may cancel the excess and refund the unearned premium.

5. Term insurance takes effect upon delivery to the Insured of the Company's Policy therefor. The sum payable as term inatiramie Insured's attained age.

Prernitun for one year.

20

0.75 25

0.78 30

0.81

35

D.86

40

0.94 45

1.07 50

1.33 55

1.79 60

2.57 64 • • • • • • 3.55

- The privilege thus has the effect of keeping the face value of the policy intact by increasing it to the extent of the loan by a temporary assurance from year to year. Whether such a clause is in a policy or not it is open to -anyone to give effect to it, and it only serves the purpose in the Assurance Policy of drawing the holder's attention to such a facility. Bankers and others would do well to put before borrowers on Life Policies and other securities the value of a collateral cover to their estate to the amount of the loan.

Building Societies have done quite good work in ad- vancing the necessity of a Mortgage Extinguishment Policy in respect of House Purchase Loans, and it is open to other concerns whose business is largely that of making advances to do the same. The type of policy to suggest largely depends upon the probable duration of the loan. The cheapest collateral death cover is a Tempora, r Policy, but this involves the risk of possible deterioration in health, so that a Convertible Term Policy, although slightly more costly, is a better protection if the loan is likely to be outstanding for some years.

The special case of a loan against an existiAg Endow-

'shall be applied to the cancellation of the indebtedness. PREMIUMS FOR MICR $100 OF TERM INSURANCE.

went Assurance Policy maturing in a few years is an excellent case for suggesting an additional premature death cover to the extent of loan. Immediately the loan is granted it means that the death-family-provision is to that extent depleted. This, however, is remedied at small cost by a temporary policy over the remaining term of the policy. The face value of the policy is thus pro- tected against theloan if death intervenes, and if the borrower survives the term of the original policy against which he has borrowed, the amount then payable there- under redeems the loam The cost of protecting a loan of £100 against the death of the borrower Over various terms is shown in the fob lowing table, which is self-explanatory and represents but a proportionately small addition to the interest a borrower is usually willing to pay for accommodation.

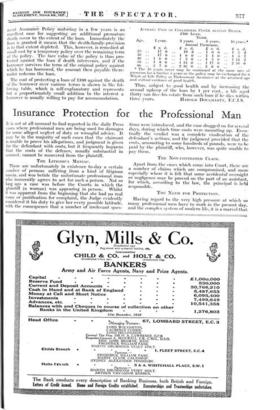

AVERAGE COST OF COLLATERAL COVER AGAINST DEATH.

10 year • £ a. d. 1 5 2 1 • 5 2 1 14 2 2 16 0 ..

- The 10 years cover may be continued at the same rate of premium for a further 5 years or the policy may he exchanged for a Whole of Life Policy or Endowment Assurance at the attained ago and without evidence of good health.

Thus, subject to good health and by increasing the annual upkeep of the loan by 1 per cent., a life aged thirty can free-his estate from such loan if lie dies within £100 LOAN.

TERM.

Age. 1 year. 3 years. 5 years.

Annual Premiums.

t a: d. £ a. d. £ a. d.

20 .. 17 0 .. 19 6 .. 1 0 0

30 17.6 .. 1 0 0 '1 1 0 40 .. 1 0 0 .. 1 3 0 .. • 1 5 0

1 8 0 .. 1 13 0 .. 1 17 0

* 60 .. 2 7 0 .. 2 16 0 .. 3 6 0

Previous page

Previous page