Investment Notes

By CUSTOS

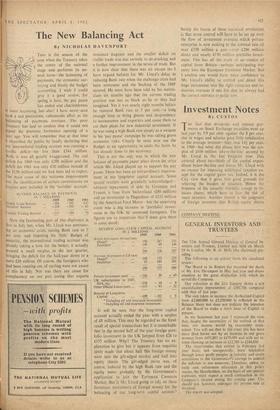

TIII fact that dividends and interest pay- ments on Stock Exchange securities went up last year by 5.9 per cent. against the 8 per cent. rise in wages and salaries gave little satisfaction to the average investor—they rose 141 per cent. in 1960—but what did please him was the sur- plus of £410 million 'above-the-line' secured by Mr. Lloyd in the last financial year. This covered about two-thirds of the capital expen- diture below-the-line and leaves Mr. Lloyd with no excuse for imposing additional taxation ex- cept for the capital gains tax. Indeed, it is the City view that it gives him good grounds for relieving the burden of taxation. Hence the firmness of the security markets, except in to- bacco shares, which have to face the risk of more taxation. Another reason is the judgment of foreign investors that British equity shares

are cheap. Certainly they are more attractive than American industrial equities. Over the past five years, while the American gross national product has been rising at about 5 per cent. per annum, the total net profits of American corporations have dipped, recovered, but not risen. Yet Wall Street has been steadily raising share prices. It is perhaps a warning to investors

' to switch from American to British equities where yields are relatively higher—from over 3 per cent. on good store shares to 5 per cent. to 5f per cent. on good chemical companies {like la and LAPORTE INDUSTRIES) and up to 7 per cent. on electrical manufacturers.

A Switch to La Rinascente

Probably British equities are also more attrac- tive than most continental equities—with the possible exception of Italian. I have read an in- teresting broker's circular advising a switch from food shares like TESCO and . LONDON GROCERS, yielding 1.6 per cent. and 1.3 per cent., and from MARKS AND SPENCER, yielding 2.3 per cent., to the Italian chain store LA RINASCENTE, yield- ing only 0.8 per cent. This was on the grounds that the continental retail trade is only at the stage of development reached by the British industry ten years ago and therefore has the same prospects of dynamic growth ahead. Italian stores of the Rinascente type count for only 2 per cent. of the national retail sales, while their British equivalents have over 30 per cent. of the UK market. The recent growth of London Grocers and Tesco has been more spectacular than that of Rinascente, but the scope for' super- market expansion in the UK, with 9,500 self- service stores, of which over 700 are super- markets, is now more limited. At the end of this year Rinascente is expected to 'have thirty supermarkets in operation as against twenty last year. I would not, however, advocate an ex- change from Marks and Spencer, which is now 10 per cent. below its high level.

Singer and Friedlander The shares of the merchant banks are such fashionable 'growth' stocks that it is impossible to get a reasonable yield. (Consider 1.2 per

cent. from REA BROTHERS, 1.7 per cent. from Shroeders-Helbert Wagg and 1.7 per cent. from

Mercury Securities—half Warburgs.) There is, however, a chance of an increase in dividend or

a 'rights' issue with the maintenance of dividends from SINGER AND FRIEDLANDER, whose pre- liminary figures for the year ending December will be published about April 20. The company carries on business as investment bankers and dealers in securities in London and New York and is believed to have had an excellent year's trading. With its continental connectioes it stands to gain from our entry into the Common Market. At 21s. the 5s. shares yield currently 2.1 per cent. on the 9 per cent. dividend, which I think could well be raised to 10 per cent.

Previous page

Previous page