The Economy

A Coming Attack on the Pound?

DAVENPORT By NICHOLAS

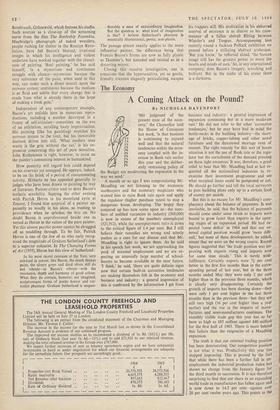

A month or so ago I was congratulating Mr. Maudling on not listening to the economic soothsayers and the monetary magicians who wanted him to raise Bank rate again and apply the regulator (higher purchase taxes) to stop a dangerous boom developing. The bogey they conjured up has now come upon us—the num- bers of unfilled vacancies in industry (368,000) is now in excess of the numbers unemployed (321,912), while the unemployment ratio is down to the critical figure of 1.4 per cent. But I still believe their remedies are wrong and utterly useless as a cure for our disease and that Mr. Maudling is right to ignore them. As he said in his speech last week, we are approaching the peak of seasonal employment and we are ex- pecting an unusually large number of school- leavers to become available in the near future. 'I think,' he said, 'there are quite definite signs now that certain built-in corrective tendencies are making themselves felt in the economy and business and industry: a general impression of this is confirmed by the information I get from business and industry: a general impression of expansion continuing but at a more moderate rate.' He did not refer to the other 'corrective tendencies,' but he may have had in mind the bottle-necks in the building industry—the short- age of bricks, copper-tubing and other metal furniture and the threatened shortage even of cement. The right remedy for this sort of boom situation is not the use of Bank rate or the regu- lator but the curtailment of the demand pressing on these tight resources. It was, therefore, a great relief to hear that Mr. Maudling had at last re- quested all the nationalised industries to re- examine their investment programme and see what marginal items could be postponed or cut. He should go further and tell the local surveyors to pass building plans only up to a certain limit of money per month.

But this is no excuse for Mr. Maudling's com- placency about the balance of payments. It. was inevitable, he said, that the balance of payments should come under some strain as imports were bound to grow faster than exports in the open- ing stages of an expansion period. He had ex- pected 'some deficit' in 1964 and that our ex- ternal capital position would grow 'more diffi- cult,' but none of these developments, he added, meant that we were on the wrong course. Recent figures suggested that 'the trade position was im- proving with exports rising and imports now for some time steady.' This is surely wish- fulfilment. Certainly exports were 7+ per cent better in the first five months than in the corre- sponding period of last year, but in the three months ended May they were only 2 per cent higher than in the previous three months, which is clearly very disappointing. Certainly the growth of imports has been slowing down—they were only 1 per cent higher in the last three months than in the previous three—but they are still very high (16 per cent higher than a year earlier) and the rise in the imports of manu- factures and semi-manufactures continues. The monthly visible trade gap this year has so far been as high as £85 million against £40 million for the first half of 1963. There is more behind this failure than the exigencies of a Maudling expansion.

The truth is that our external trading position has been deteriorating. Our competitive position is not what it was. Productivity this year has stopped improving. This is proved by the fact that while there has been a further fall in un- employment the industrial production index has shown no change from the January figure for the third month in succession. It is not therefore surprising to find that our share in an expanding world trade in manufactures has fallen again and is now down to 14.5 per cent—against over 20 per cent twelve years ago. This points to the Weakness of the Conservative financial policy— the .failure to discriminate, in giving investment incentives, in favour of investment which is labour-saving and is likely to help exports and save imports and against investment which is merely catering for an expansion of the home market in conventional consumer goods. Our industrial investment has lacked an export direc- tion and technological brains.

If the balance of payments figures do not Irighten the Chancellor it must be because they are meaningless. Apart from the deficit of £67 million on visible and invisible trade in the first quarter there was a deficit of no less than £158 million on current and long-term capital transactions in three months! This was reduced to £69 million by a favourable 'balancing item' but it suggests that some flight of capital is going on. The loss of £20 million from the reserves last month was no doubt due mainly to the pull of higher interest rates abroad, but there is some reason to believe that traders are holding back foreign currency they have earned, that foreign Capital is not flowing in for investment as it Used tp, that our portfolio investment abroad Is increasing and perhaps leaking out over the rules and regulations. All this could be asso- ciated with the coming election and could point to a, sterling crisis in the autumn.

Previous page

Previous page