AN ANATOMY OF TAXATION.

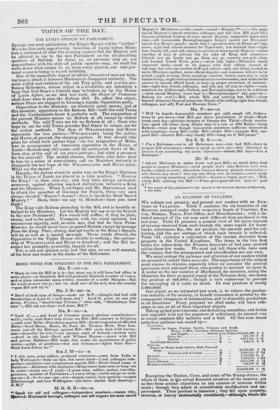

Ws redeem our promise, and present our readers with an 'ANA- TOMY OF TAXATION. Table I. contains the six branches of our Revenue, arranged under their respective heads of Customs, Ex- cise, Stamps, Taxes, Post-Office, and Miscellaneous ; with a de- tailed account of the net sum each different item produced in the last year. Table II. presents a general view of the gross amount of revenue received from each branch, the sums repaid for draw- backs. allowances, &c., the net produce, the amount paid for col- lecting, and the per centage at which each branch is collected. Table III. contains a calculation of the income derivable from property in the United Kingdoms. The items in the two first tables are taken from the Finance Accounts of last year. printed within these few weeks. We need not tell those who have seen the volume, that the arrangement and classification are our own.

We must entreat the patience and attention of our readers whilst we proceed to unfold these accounts. The importance of the subject must excuse its dryness, especially when we consider the general

ignorance even amongst those who profess to instruct us upon it. A writer in the last number of Blackwood, for instance, rating the Ministers for their proposed repeal of the Tobacco-duty, sets down the produce at 800,0001.; though a vain endeavour to prevent the smuggling of it costs as much. Its real produce is nearly 3,000,0001.

Our object, as we intimated last week, is to relieve the produc- tive industry of the country, to benefit consumers in general by the - consequent cheapness of commodities, and to stimulate production in all directions. Every proposal we shall make will have refe- rence to one or all of these important objects.

Taking up last year's income, and deducting casualties, and duties now repealed (but not the expenses of collection), its amount was in round numbers fifty millions and a half. Of this sum about forty-fimr millions was raised by—

CUSTOMS,

Duties on Sugar, Foreign Spirits, Tobacco and Snuff, Wineg, Coffee, Currents, Molasses, Raisins,

and Pepper, headed A in Tables .• Corn, &c c

.. Timber . F

Incidental Revenue K

EXCISE,

Duties on Rome-made Spirits, Malt,Tea,and Hops L •• Licences and Aurtion 2W ••

STAMPS,

T4XIC9, , Q • • POST-OFFICE, R ••

MIsCEakANEoUs S ••

X13,555,493 790.109 1,053,885 118,212 12,127,857 1,033,323 7,248,023 5.294.870 2,212,206 545,4160 3 5

17 8

14 10

9 0

3 04

17 10* 14 6 6 10i 5 n 12 411

£44,028,803 5 2+

Excepting the Timber, Corn, and some of the Stamp-duties, the whole of these, in the actual financial situation of the country, are as free from serious objections as any sources of revenue within reach ; though they admit of considerable modification and im- provement. Their produce is immense ; they fall upon property, revenue, or luxury abstractedly considered,—although,.where the

rate of duty is disproportionately heavy, they may injuriously inter- fere with trade. The remaining sum of about six millions and a half is thus

made up—

CUSTOMS,

Duties on 33 articles of luxury beaded B in Tables.£266,264 11 3 8 .. (necessaries)......... I) .. 186,719 2 0

„ 33 .. Foreign Manufacture. E 316,878 16 7 .. used in Manufactures G 2,040,208 17 9

.. of British Manufacture

and British produce exported... ..... H 127,618 12 0 EXCISE,

Duties on Soap, Paper, Glass, Candles, Bricks, and Tiles, Paper (stained), Starch, Vinegar,

Sweets and Alead, and Stone Bottles N 3,526,936 7 9 X6,494,626 7 4

And though less destructive of wealth than the taxes some govern- ments have established, they are mischievous in no common degree. The expense of their collection is disproportionately great—innume- rous cases perhaps equalling the sum they produce. Many articles are subject to various rates of duty, according to the place they are shipped from ; others are chargeable by measurement, the duty 'varying with the size; and hence, continual difficulties in ascer- taining the amount, with innumerable vexations, frauds, and de- lays. Some are articles of necessity,—as butter, cheese, soap, candles. In certain cases, the processes of the manufacture are prescribed by law ; and thus invention is checked, and improve- ments are prevented, whilst the trader is subjected to domiciliary visits without a corresponding object. Requiring early payments of the duty to Government, they create a species of monopoly- in favour of the large capitalist, to the injury of' the small capitalist, of' the public, and eventually even of the monopolist himself, by the premium the taxes offer to the smuggler. Many of the duties, by being placed upon raw produce, or upon materials used in manu- facture, fall upon the article in the earliest stage of its progress, and enhance its cost without benefiting any one ; whilst by (use- lessly) raising prices, they check the employment of capital and labour, to the injury both of consumer and producer.

Our plan is to repeal the whole of the duties last enumerated ; and thus to relieve trade, to save expense, and to simplify our system of taxation, by confining the Excise to four articles and the Cus- toms to eleven—instead of nearly six hundred, as at present.— The question is—can we raise the sum proposed to be remitted, without creating greater inconvenience than the present duties themselves ? We think we can, and a portion of it without any difficulty whatever. There is at present a bounty on exported linens, which annually costs the public 200,000t. ; thanks to Sir HENRY PARNELL, this flagitious waste of money terminates with the present year. The bounties and incidental expenses, humanely but fruitlessly squan- dered in endeavouring to put a stop to the Slave Trade on the coast of Africa, annually amount to upwards of 350,000/. As this ex- penditure utterly fails in effecting its object, it should be disconti- nued. The Lord-Lieutenant of Ireland, and the expenses neces- sarily incidental to the Viceregal establishment, cost the public 250,000/. per annum*. • We have thus 800,000/. applicable to a reduction of taxes, by merely willing its application. The unfair advantage which real property possesses, is one of the proofs of the necessity for Reform. It pays neither Probate nor Legacy-duty, although personal property is subject to both. The enormous real estates of our aristocracy are not chargeable 'with a single farthing when they are transferred upon death. The personal property of the merchant or the trader, acquired as it is by honest industry—even the hard-earned savings of the mechanic —cannot be inherited by his family or his friend without being subject to duties varying from one to ten per cent. If this mon- strous inequality. this aristocratic immunity from taxation, were rectified (which it doubtless will be), and real property sub- jected to the same duties as personal, its produce may he rated at 1,350,000/. The latter, indeed, in the last year produced 204,430/. ; but as real property generally descends in a more direct line than personal, we only calculate it at that amount.

The saving in the collection we set down at 400,000/. It might be a great deal more if the alterations were properly made, for many of the lesser duties would save themselves ; by abolishing bounties and drawbacks, the management of four millions of money would be got rid of; and the machinery is already existing to col- lect both Legacy and Probate duties, and a Property-tax, without much additional expense.

To accomplish all we propose, a farther sum of about four mil- lions is required ; which might be raised without difficulty by a graduated tax on Property alone. The incomes arising from in- vested, or quasi invested capital—i. e. from rents, from the Funds, from annuities, from sinecures, and from Church pie:Telly, may be taken at eighty millions, after deducting twenty millions as falling below the rate of income at which we should propose to begin. Take five per cent. as a medium, and we have the sum required. We need scarcely add, that the scale should be consideialely gra- duated, pressing lightly upon the smaller, and more hesvily upon the larger properties. It need not, probably, rise higher than ten per cent, upon the highest. In the above enumeration, we have omitted certain offices (such as patent places), and pensions,' allowances,' and • half pay.' The 'whole of these may amount to between seven and eight millions; and, in strictness, they ought to be subjected to the tax. Some may be averse to this proposal, as regards half-pay ; yet how does

• Financial Iteform,3rd ed. ppe120, 228, 257.

an annuity purchased by exertion in a military capacity, differ from one procured in a civil ? Its amount is permanent ; it is saleable; it can be charged with annual payments ; and though it may be earned by as much labour, it is not earned by the exercise of the same economy, as that purchased from the savings of the citizen. Much of this half-pay, &c. has not, however, been earned at all. It has been obtained by the scions of a noble stock,' who entered the service with the fraudulent intention of charging the country with an annuity. Surely there must be some mode of meeting the case! Might not the half-pay of a man who had neither been on active service, nor served a certain period, he charged with a high rate of duty, whilst the man who had should be rated in the same proportion as the possessor of other property ? To resume. Our account will stand thus— We have alluded to the modification of the first class of Taxes, where much relief might be afforded. The inqusitorial Window tax could be abolished, and the House-duty proportionably raised; at the same time, the present partial manner of assessment should be remedied. If Mr. HUME'S proposal were adopted, and Corn subjected to a fixed rate of duty, it would probably become a staple branch of revenue. An increase weuld follow an alteration of the Timber-duty, upon the two articles we somewhat unwillingly re-

tain. If the Newspaper-lax were reduced to a penny, very little if any loss of income would follow ; while the proposed Ministe- rial reduction will hardly be a boon to any one, and a probable injury to the revenue. The same observation holds good with reference to the Stamps on Fire and Marine Insurances; the high rate of duty on both of which has had the effect, in the first case, of deterring many from insuring at all, and, in the latter, of transfer- ring much of our business to II (Aland and America. By increasing the tax on Brandy and Geneva, the revenue lost half a million in a total amount of about a million and a quarter. Were the duty reduced to 12s. or 14s. per gallon, a benefit would be con- ferred on the middle classes, and on the public income (notwith- -standingany diminution in the consumption of British Spirits), with a probable decrease in the smuggling of the articles. It would be useless to interfere with Tea, till the East India Company's charter is settled ; when, in addition to lowering and equalizing the duty (which can be done without loss), its collection must pfohably be transferred to the Customs. Wine and Tobacco are article: where a decrease, however desirable, is not of very urgent import- - once. In dealing with them, the only question is—what rate of duty will produce the greatest revenue, and (in the case of the latter) prevent smuggling? The absurd Malt-Laws will, of course, be revised. It is an act of justice due to the maltster, to the public, and to the agriculturists.

The duties upon both Malt and Sugar could also be reduced ; and

if judiciously set about, the reduction in the latter might be accomplished without any heavy loss of revenue. Under every

disadvantage, the Malt -duty is steadily increasing. If the rate were lower, and the trade less shackled, a sufficient increase might take place to make good any trifling deficiency in other quarters.

We must say a word or two upon Drawbacks. The total amount of repayments under this head was 3,527,754/. Of this, 3,049,493L was upon three articles, which we enumerate —

Hera ments and Gros. Produce. Drawback,. A Ilin. flaws. Net Produce.

E.736,47.1 .... 183.569 .... 2,106 ....

500,499 G Printed Goods

2. H 0,238 ....

1,578.669 38 .... 570,330i Sugar 6,01'3,321 .... 1,266,753 .... 9,226 .... 4,767,342

X8,049,033 3,049,491 11,370 5,888,171

If the plan we have suggested were fully carried into effect, draw- backs could be abolished altogether. But they require a little more

examination. It appears that we are charged with the expense of collecting and repaying 920,343/. on Glass to secure a revenue of 550,4991.; and that if the duty were remitted, and the cost of pro- duction consequently lessened, an increased exportation would probably follow. But what shall we say to Printed Calicoes ?- for little else is exported. The manufacturer was saddled with the expense and the vexation of pay ing the duty, and the merchant of getting it back again, whilst the public was paying for collect* three millions and a half of revenue to net (deducting the expense of collection) about two or three hundred thousand pounds; and all this injurious and complicated process was placed upon a staple article of manufacture ! Mr. HUME cannot do every thing, but what were other honourable members about ?

It will be seen that we have cautiously confiner' ourselves te our subject. The general expense of collecting the revenue— the mode in which the public business is transacted—and in which retrenchments might be effected—would each require a separate article.

We have done our duty ; it remains with the people to do theirs. Much in the way of simplification and partial relief may be effected by merely willing it. Much more might be done by judicious and dectiveretrenchment. But if the industry of the country is to be

Saving by abolishing bounties posed to be repealed £6,494,626 on Linen, expenses of the Slare-Trade,and of the Lord-

Lieutenancy of Ireland £800,000 Saving in the collection of the Revenue 400,005 Produce of the Legacy and Probate duties on Real Pro-

perty 1,350,006

Produce a a. graduated Pro

perty-Tax 3,944,626 #6,494.626 46,494,626 Loss of Revenue by Taxes pro-

unshackled, and our system of taxation placed upon a sound and simple basis, it can only be effected by resorting at once to a pro- ductive source of revenue, and compelling that property to contri- bute its full proportion to the public expenses, which more than any other requires the public protection.

CUSTOMS-UNITED KINGDOM.

ARTICLES IMPORTED.

TAXES ON LUXURIES.

' (Commonly so called, though some of them have in reality become necessaries.)

3 5 It is not unworthy of observation, that from Wines, English and 'Foreign Spirits, and Malt and Hops, upwards of 13 millions of revenue, or one fourth of the whole, is derived ; and that, if the duties on Fo- reign Spirits were lowered, and the Malt-Laws re- vised, another million would probably be raised. Truly we are a bibacious people. It is not altogether as articles of general consump- tion or of luxury, producing a large amount of reve- nue, that the above are so well qualified for judicious taxation. The moment they arrive they are ready for consumption. They are collected, too, with facility, in large amounts, at once, and with scarcely the possibi- lity of dispute. A man may cavil about the measure- ment of an article, but he cannot very well deny the weight of a hogshead of sugar, or the gailge of a pipe cf wine. They also entirely defy smuggling upon a small scale ; and a judicious reduction of the duty upon Spirits would go far to diminish it upon that article. Tobacco, we believe, must remain for the present.

(B.)--28 Articles of Luxury,producing

1: 266,264 11 3

Lemons and Oranges . ....... £39,245 16

0

Rice . X4,250 1 8 1 in the Husk 25,956 11 / j 30,106 12 9

Licorice Juice .... ..... • •• 21.192 5 11

Figs 20,819 17 6 '"::1 Almonds .... . 18,274 0 5

Nutmegs 15,138 0 I

Cocoa, Cocoa Nut, Husks and Shells, and Chocolate 1.3,61 13 3

Oil, Chemical and Perfumed 7,831 8 7

Beer, Spruce ....... ...

7,732 11 5

Prunes 7,5:19 6 1

Pimento , . ... 7,249 8 4

Cloves . . . ....... ...

6,161

9 7

Water, Cologne, in Flasks 4,271 11 1

Ginger (Dry) .. 3,539 18 10

Essence of Bergamot and Lemons 3,087 17 11

Fish-Anchovies £1,431 11 9)

Eels 924 16 6 ,`• 2,871 5 9

Oysters 314 17 61

Coral Beads .. . . 2,758 10 3

4."

Vermicelli and Macaroni .. 2,211 13 3

Mace . 2:255 3 3

Juice of Lemons, Limes, and Oranges 2,1112 1

a

Capers. ..

1,721

11

Grapes 1,640 19

a

Sago 1,623 13

Tamarinds 1,179 7

10

Cinnamon 709 5

Plums, dried 545 14 2

Protecting Duties on Rent.

Nuts-Chesuuts 4:1,-125 15 11

Small 13,557 7 0 16,593 2 7

Walnuts 1,610 0 6

Apples not dried. 4.230 6 6

266,264 11 3

(A.)-9 Articles of luxury, producing 13,555,493

Net Produce.

Sugar £4,767,342 0 7 -Spirits-Rum £1,599,445

6 11

Brandy. 1,432,004 5 6

Geneva Of another sorts... 34,668 11,009 7 2 16 5 3,079,952 10 I Of the manufacture of Guernsey & Jersey 2,824 14 1

'Tobacco and Snuff

2,924,204 13 1/ Wines of all sorts

... 1,524,177 18 3 Coffee

579,563 10 7 Currants.

. 261,670 5 2 Molasses

159,683 6 11 Raisins

158,546 15 1 Pepper of all sorts

100,492 2 10

£13,355,493 3 5

The above are proper subjects of taxation in their nature. We propose their repeal on account of the trifling sum they produce. If the remission be ob- jected to, the first seven articles,producing 178,4484, might be retained for the present. The others, some twenty in number, should immediately be swept away ;: for of the 87,816/. they nominally produce, not above half-perhaps not even any-eventually reaches the Exchequer, owi ng to the expenseof their collection, and to the excuses a number of items afford for creating the appearance of business and keeping up a compli- cated and costly machinery. Tile repeal of one or two would, of course, effect no saving.

TAXES ON NECESSARIES.

Protecting Duties on Rent.

(C.)-Corn, Grain, Meal, and Flour (including Buck Wheat) £790,109

Under the present law, Corn is a very uncertain source of revenue, and depends entirely upon our harvest. Unless the present complicated scale be abolished, and a fixed but moderate rate of duty sub- stituted, it can scarcely be calculated upon as a source of income. (D.)-8 Articles (chiefly Necessaiies) producing Protecting Duties on Rent.

Butter £102,752 3

X 186,719 0

Cheese 54.870 19 5 Eggs . 18,505 14

Quills (Goose) 4,252 19 1 Rapeseed and other Oil Cakes 2.731 1 1 Bacon and Hams 2,164 13 3 Horses . 1,149 12 0 Beef, salted ....... . 291 18 10

£186,719 2 0

The above, ,though termed protecting duties on agriculture, in reality only protect rents, and benefit nobody but ,landlords. Our readers must not sup. pose that the mere sum taken from the public in the shape of duty is the whole extent of the injury. Prices are raised by the amount of the tax. The duty on Butter, for instance, is 20s. per cwt. or W.' per lb. ; consequently every pound of Butter pur- chased within the sphere of the duty's operation is artifiCially raised in price to that amount. We have allowed the staple article (Corn) to r•-main for the present. There is not a shadow of reason for retain- ing the others.

TAXES ON FOREIGN MANUFACTURED ARTICLES.

(E.)-29 Articles of Foreign Manufacture, producing £346,878 IG 7 Protecting Duties on Trade. Silk Manufactures, East India £21,071 5 4} X 156,:; '3

3 1 - not East India 135,251 17

Hats, of Chip and Straw 48,281 4 11 Linens, Foreign 20,699 9 6

Leather Gloves 19,458 IS 7

- Manufactures of, ex- cept Boots, Shoes, and 20,250 6 9

Gloves Glass, viz. Bottles, Green or Common 11.472831 8 2

3 9

17,133 4 6 - of all other sorts 5,650 0 9

Books 11,810 14 2

Woollen Manufactures not otherwise de- scribed. including carpets

9,916 16 4 China Ware, Porcelain, and Earthenware 7,087 1 8 Mats of Russia. £5,637 17 0 I -' of other sorts

Clocks 1 141 14 6 /

6,779 6,348 11

7 6

J.

Half; or Goats' Wools, 3Ianufactures of . 4,798 3 0 Embroidery and Needle Work.... 4,728 7 7 Boxes of all sorts.. 3,764 13 11; Toys 3,577 13 5 Boots, Shoes, and Calashes 3,495 10 / Pictures. 3,405 13 0 Cotton Manufactures not otherwise de- scribed 2,400 12 10 Bugles 2,746 16 4 Musical Instruments 1,965

7

3 Prints and Drawings 1,918 16 0 Paper for Hangings 1,175 18 9 Vinegar 1.427 15 0 Ships' Hulls and Materials 1,415 19

Lacquered Ware 1,079 4 7 Baskets 843 3 6 Corks (ready made). 799 1 0 Flowers, artificial, not of sill 776 12 10 Lace Lace Thread 643 11 6 Cordage and Cables 145 16 11 X 346,878 16 7

In not a few of these cases, the annual amount of duty is small, because the duty is nearly, if not al- together prohibitory, with the view of protecting home manufactures ; in some, however, the amount is trifling, from another cause, namely, because the article is in small demand. These are cases for re- mission, those for modification. If trade were en- tirely unshackled, protecting duties might be alto- gether abolished.

TAXES ON TRADE.

(F.)-1 Article of Materials used in Manufactures, • &c., producing 1: 1,053,585 14 10

Timber-Deals and Deal Ends Fir, 8 inches square, or upwards...

£560,531

.. 493,033

X,1,053,585 17 11 16 11 14 10

It is here that small means may be made to produce the greatest effect. The whole of the following, whether protective or otherwise, are ob- jectionable in point of principle ; the majority trifling in point of amount. Of the two millions they produce, 1,693,4931. is obtained from twenty-two articles, not rating subdivisions. The remaining 346,715/. is produced by several hundreds. These latter should be repealed at once. Almost every article here enumerated furnishes employment to labour, and frequently to many labourers, before his finally fit for use. Some of the trades may not, indeed, be staple ones, yet none are unimportant ; and they all, we again repeat it, employ labour. The loss attending the repeal of these duties would, in reality, be very trifling, on account of the expense in collecting them. Sir HENRY PARNELL consi- 17 8 dell every Custom-duty, producing less than 10,000/. a year, costs as much to collect as it pro- duces.

We should always bear in mind, that a small duty is just as troublesome and expensive to collect as a large one, whilst the mere amount of a trifling tax is the smallest item in the price it enhances.

(G.)-99 (enumerated) Articles of Raw Materials, or serving as prepared Materials for Manufacture, including a few Drugs, producing £2,040,208 17 9 £359,988 0 5

103,077 18 2 Mahogany ...... 59,889 17 5 Turpentine (common) 57,688 19 10 indigo 34,262 4 9 Furs of all sorts (many subdivisions)... 31,936 3 it

Gums-A:6mi and Copal.t. 3,054 5 10 Arabic ...... 6,383 17 11

Lae, of all sorts 5,988 4 9 Senegal .... . .. 4,457 17 10 Tragacanth ... 1,909 15 0 21,294 09 Skins, not being Furs (many subdinisions) 17,196 16 10 Silk-Raw £15,650 19 2 1 Waste knubs and busks 214 14 111 15,36 5• 14 1 Cork. unmanufactured 13,240 9 10 Valonia 11.376 4 4 Rosewood 10,490 9 10 Spelter .... . ... 9,365 6 6 Sinalts . 9,311

15 7

Senna... 9,027 0 4 Tar 8,643 14 2 Brimstone.. 6,628 16 3 Sarsaparilla 5,949 19 11 Juniper Berries 5,656 5 9 Acid (Boracic) 5,982 3 11 Shumac .. .. 5.276

8 7

Balsams . . 5,269

19 1

Quicksilver 4,951 15 0 Ashes (Pearl and Pot) . 4,930 14 6 Opium .. . . . ............... 4,528

0 0

Cochineal, Gramilla, and Dust 4.465 7 5 Rhubarb 4,393 18 10 Aloes 4,210 8 9 Flax and Tow, or Codilla of Hemp and Flax 3,963 19 2

Verdigris .

3,874 16 6 Canes, of all sorts .. 3,729 13 0 Saltpetre ............ 3,690 18 4 Elephants' Teeth .... 3,688 16 8 Jalap .. 3,619

7 5

Sponge 3,489 15 6 Isinglass 3,419 13 8 Cantharides 2,703 11 6 Cream of Tartar 2,653 18 / Alkanet Root 2,651 7 1 Rags, 8:e. for Paper 2,312 13 8 Scammony 2.287 13 10 Arrow Root or Powder 2,203 13 10 Yarn (Cotton) £1,141 1 4 1 Linen (Raw) 962 4 2 1 2,103 5 6 Argol • ••• ....... • • 2,039 11 9

1,993 1 2 Cubebs .. 1,854 6 0 Boxwood - • • •• • • •• ........... • • 1,814

14 7

Marble Blocks ...... ... 1,613 0 1 Grains (Guinea) 1,809 16 0 Borax 1,626 3 9 Yellow Berries 1,609 8 10 Burrs for Millstones 1,602 15 5 Bark (Quercitron) 1,396 12 6 Cassia Lignea 1,323 15 11 Succadees 1,317

11 7

Aunatto 1,246 6 IL Myrrh 1,206 6 9 Fustic . 1,201 15 3 Manna 1,146 2 6 NicaragnaWood 1,094 13 10 Ostrich Feathers 1,062 8 9 Ochre 954 11 11 Hair (Human) 846 3 8 Tortoise-Shell 817 9 2 Zaffar 797 7 4 Radix (Ipecacitanha) 775 19 6 Pitch 737 18 2 Cedar, under 8 inches square 525 4 10 Angelic: 520 1 3 Orchal and Orchelia 353 12 5

£915,999 17 9

The preceding observations equally apply to the following duties, but some of these are ridiculously mischievous, and afford a fine specimen of the protec- tive system. We hear muds about the importance of the shipping interest, and the people pay a large sum annually for its exclusive advantage, and that of a few Canadian timber-cutters. The West In- dian planters are taxed for their benefit in the same: way. Yet, lest any trade should be too free, hemp, cordage, iron, timber, pitch, and tar, the staple ar- ticles of ship-building, are subjected to duties.

Take another instance, where the protections run in a circle. Mr. GOULUVRN piqued himself upon the repeal of the Leather-duties. Let's's see what Ise did. He remitted a duty of 400,000/. a year, but left the taxes upon hides exactly where they were ; so that the landed interest would be the only gainers in the long run, as we shall endeavour to show. When hides are imported wet, they are subject to a duty of 2s. 4d. per cwt. Our immediate neighbours can consume the greater part of their own leather, and wet hides cannot he imported from a very great dis- tance. If dried, the case is altered as regards the space they can travel, and the duty is-doubled. Leather, which can be carried any distance, is subject to a tax of sixpence per pound. This we shall be told is to protect tanners ; but then, to protect land- lords in their turn, bark, and extract of bark used in tanning, are both subjected to duties. Amid all this protection, the gentle craft cannot be abandoned, and accordingly there is a duty upon boots, shoes, and FalOches. It is unnecessary to observe, that, however injurious these absurdities may be to trade they are much more injurious to the public, which, like nuncle, " pays for all."

Wool (Cotton)

Oil-Castor £4,222 12 .10 Olive 71,780 13 8 • Palm 92,427 18 3 Train, Spermaceti, and Blubber 4,646 11 5

Protecting Duties on Rent, Trade, and Colonists. Timber (producing smaller sums), viz. : Battens and Batten

Ends .£110,818 8 11 Staves.. 46,672 11 2 Lath wood 30,605 3 9 Oak 8 inches square or upwards .... . 23,736 8 11 Masts and Sparc . ... 11.993 19 4 Teak 11.081 7 7 Wainscot Logs 8,272 14 0 £265,647 15 1

Oak Plank 6,212 14 4 of other sorts 6.117 19 7

Firewood 3,900 0 2

Fir Quarters 3,077 19 1

Balks and Ufers under 5 inches square 1,197 1 4 Knees of Oak 1,156 14 5 Oars 804 19 6 Tallow ....... ........................... 180,530 18 10 Seeds of all sorts (including Tares) ...... 134,782 18 8 Wool, Sheep and Lamb's 120,420 8 0 Hemp 74,318 16 5

Hides, not tanned £42,149 17 2 1 43,402 16 4

tanned 1,252 19 2 I

Bark, Oak, and Cork Tree 35,025 15 4 Bristles 26,982 Iron in bars of another sorts i 18'487 15 8 1 20 735 3 2 1 1,237 7 6 1 •

Madder and Madder Root ....... ........ 17,613 9 3 Wax (Bees'). .. .. . 5,893 2 6

Feathers for Beds .... ..... 4,560 6 6

Lead (Black) ...... 2,322 19 0 Horns, Horn tips, and Pieces 1,402 1 9 Hair, Horse .. 212 17 3 Protecting Duties on Trade.

Barilla and Alkali 48,000 5 1

Silk, Thrown ........ .... ..... ..... .. 36,858 10 1 Platting of Chip or Straw . .. . 6.689 9 10 Paper . 1,325 9 8 Soap, Hard and Soft . 1,336 19 1 All other merchandise, the articles not spe-

cified lathe returns ........... ..... 96,147 7 2 [Amount of uon-protecting duties, G,

brought onward] 915,998 17 9

£2,040,208 17 9 The non-specified articles amount to one or two hundred. Some of them produce nothing in the year, some of them only a few shillings ; and the whole cost in the aggregate perhaps a greater sum to collect than they produce. Many of them are taxes on raw produce, and many are called protective duties. The whole should be abolished without delay, whatever becomes of the others. The Silk-duties are fine specimens of legislative absurdity. First, there is a duty on manufactured silk, to protect the weaver; then, there is a duty on thrown silk, to keep him down, and to protect the silk-throwster ; then, there is a duty on raw silk, to contract the operations of both weaver and throwster. Common sense would say, abolish the raw silk-duties at all events ; but in the memory of the oldest man in the pariahs, Common Sense has never been Finance Minister, and indeed very seldom in the Cabinet in any capacity.

ARTICLES EXPORTED.'

.(II.)- British Goods or Produce exported, producing £127,618 12 0

Net Produce.

Coals and Calm £63,562

16 2 British Sheep and Lamb's Wool, Woollen

Yarn, ike. exported 1,866 3 6 Skins 25

4 7

Per Centage duty on British Goods ex- ported ........ 62,164 7 9

£127,618

19 0 We are a strange people. We protect our native productions in every way to encourage tlie home trade, yet we put a tax upon their exportation.

ARTICLES CARPUS!) COASTWISE.

(I.)--Repealed in the present year .1:993,872 18 3

Coals and Calm . . £958,299 9 9 Slates 35,573 8 6

£993,872 18 3

(K.)-Revenue arising from various incidental sources £118,212 9 0

Canal and Dock Duty . . £46,911 1 5 Duties collected at the Isle of Man 23,613 3 2 Remittances from the Plantations, includ- ing Receipts of Plantation Seizures 17,107

10 0

Proceeds of Goods said for the Duties 16,524

17 8

Rent of Legal Quays, Warehouse Rent, Wharfage, 24,747 17 10 Deduct- £128,904 10 1 Surplits Charge on account of Fines and Seizures, ex- clusive of legal expenses £9,697 0 101

(Apparently loam on) Pro- ceeds of Surcharge, Sale t

10,692 -

1 1

of Old Stores, &c. Sce.... 995 0 33

£118,212

9 0

.

(L.)-4 Articles of Luxury, producing

Net Produce

£12,127,857 Spirits (home made)

....£5,185,574

4 9* Malt

3,436.279 14

2

Tea

.. 3,387,097 18 91

Cops .......... ...• • • • •

118,919 5 3k

£12,127,857 3'

These are proper subjects of taxation-if not at all times, at least as long as fifty millions of revenue must be raised. The Hop-tax is objectionable, on £19,478,964 2 9

EXCISE-UNITED KINGDOM.

TAXES ON LUXURY.

Commonly so called, though some of them hare in reality become necessaries.

3 0/

account of the uncertainty of its produce, and the vexations which attend the collection. It might be repealed without difficulty.

(M.)-2 Articles (Licences and Auction-duties) producing £1,083,823 17 10i Licences.... .. .....

Auctions

Licences were, perhaps, originally established to make the Excise acquainted with the name and ad- dress of every dealer. They have now become an important branch of Revenue. The duty upon Sales by Auction is not one we should propose to establish now, but its operation is finite, and its produce considerable. We imagine it must stand for the present. Both these duties might be advantageously transferred to the Stamp-office, which could furnish the Excise with a list of the few classes of traders over whom its power would still extend.

TAXES ON TRADE.

(N.)-10 Articles of Manufacture £3,526,93G 7 9

Soap Paper. £1,249,681 687.308 13 10f 12 llf Glass ........... . . 550,499 14 5 Candles 989,413 19 10* Bricks and Tiles 348.4t1 17 If Printed Goods (Paper, Stained) say

100.000 0 0

Starch

840,33

3 If Vinegar 17,862 14 2f Sweets and Mead 2,730 8 6 Stone Bottles..... 2,691 3 S

£3,526,936 7 9

The whole of the above are of a most injurious de- scription ; objectionable in principle, mischievous in effect. They injure the people both by raising the prices of necessaries and by checking the demand for labour. Glass, for instance, is an article whose con- sumption is capable of an indefinite extension both at home and abroad. The materials are cheap, they are of native production ; and the chief outlay both in the manufacture and in the machinery, and the buildings requis:te to establish the manufacture, is for labour. The same observations apply to Candles, Soap, and Paper. Bricks and Tiles, and Timber, are, by an odd coincidence, connected with the whole of these duties ; for, in these branches of trade, the principal outlay is the capital expended in buildings. Why the duty on Paper Stained should not have been remitted with that on Printed Calicoes and Oil-cloths, is inconceivable. Its produce is about one-fifth of theirs, and its operation the most injurious of the whole. Since the repeal of the duty (3/d. per yard), oil-cloths have fallen 6d. and 9d. per yard. This fact speaks volumes. It should he observed, that the duty on Soap does not extend to Ireland.

In any duties affecting manufacture, it is much better to repeal one than reduce two. The reduction is merely a benefit to the extent of the amount re- mitted ; the injury to the manufacture, and the ex- pense of collection, remain the same. We mention this, as Sir HENRY PARNELL in several places rearm- mends a reduction of the Soap-duty.

(0.)-Duties Repealed in the last or present year.. £3,059,176 18 81 Beer. £2,345,122 10 sa

Printed Goods (Calicoes and Oil-cloths)

say 470.330 15

Of

Rides and Skins (Leather) 194,678 10 8 Cyder and Perry 49,045 2 4 £3,059,176 18 8.1

46.60

£818,469 234,854 14 2 111 11 .R1,083,323 17 10/

6

£19497,294 7 41

The Leather-duty ceased at Midsummer, the Beer- duty at Michaelmas, that on Printed Goods was re- pealed this year.

STAMP DUTIES.

(P.)--Produce of the United Kingdom GREAT BRITAIN'. Nat Produce.

Deeds and other Instruments not included

under any of the following heads £1,492,578 Probates of Wills and Letters of Admi- 10

£7,248,083 14

If nistration 826,678 13 6 Bills of Exchange. 455,797 18 6 Bankers' Notes 34,270 19 3 Composition for the Duties on the Bills and Notes of the Bank of England, and of Country Bankers •• 75.953 3 5 Receipts . . 205,640 16 Of Marine Insurances 217,5.4 15 6 Licences and Certificates .. 155,487 7 11 Newspapers and Supplements, and Pa- pers for Advertisements 410,980 6 6 Almanacs 26,293

11 6 Medicine . .. 34,387 15 10* Legacies 1198,756 10 7 Fire Insurances 733.162

1 0 Gold and Silver Plate 77,152 9 Of Cards 14,509

7 0 Dice 1,294 0 0 Pamphlets 1,019 13 9 Advertisements 157,482 7 4 Stage Coaches... 418.598 5 9f Post Horses 220,357

12 10 Race Horses ••••• 1,391 14 flf

Penalties in Law Proceedings and Costs Received 10.137 0 11*

6,769,445 1 10

IRELAND.

Deeds, Law Proceedings, and other writ- ten Instruments, except Probates and Letters of Administration, Itc Bills of Exchange Receipts Bankers' Notes and Post Bills. . Composition from the Bank of Ireland, and other Banks, in lieu of Stamp Du- ties . . . .

Protests Newspapers Almanacs Advertisements Fire Insurances Marine Ditto

Probates and Letters of Administration

Legacies Cards and Dice Gold and Silver Plate, and Licences.....

Game Certificates Attornies' Indentures Admissions Barristers' Admissions.

Students' Admissions Pamphlets Penalties and Costs Received 415,564 19 Of

Law Fund . 45,967 10 7

Equity Exchequer Fund 2,927 3 8f

Chancery Fund 14,278 19 31 478,638 12 8 Amount of stamps in Great Britain brought down ......... 6 769,445 1 10 Total ....f7,248,083 14 6

The whole of the Stamps require regulation ; which might be effected without much loss. The duty upon many of the deeds and other instru- ments should be more regular in its ascent, and not fall so heavily upon property of small value. The duty upon wills and letters of administra- tion requires revisal. " The representatives of the deceased must swear to the amount of his property, without deducting his debts ; and, although the duty is afterwards returned (but with considerable trouble and ex- pense), it frequently inconveniences the poorer classes, who may not have the immediate means of paying the duty on the probate, without which they cannot act. The duty on race-horses probably costs as much to collect as it produces. It should be abolished, with that on cards, dice, and pamphlets.

At present, licences fall very unequally; many classes, and those the best able perhaps to bear a deduction from their income, are totally ex- empt. An extension of the principle, in the nature of a poll-tax falling generally upon professional men, has been suggested to us. It has also been proposed to subject divideods from the Funds to the operation of the receipt-stamp-duty. Neither plan is objectionable in principle; for what is more unjust than to exact an annual duty from the solicitor, but to allow the barrister, physician, &c. to escape altogether? or why should the large fundholder receive his ten or twenty thousand a year without a stamp, whilst Government will not receive its own taxes without charging the payer with the stamp ? If this latter proposal were acted upon, receipts for large amounts should be chargeable with a higher rate of duty.

All practicable proposals for drawing a greater revenue from Stamps are well worthy of consideration, on account of the small expense at which they are collected ; and, as the machinery already exists, any ex- tension of business could take place without any other cost than the sa- laries of a few clerks.

TAXES.

(Q.)-Preiuce of Taxes (so callcd in the Exchequer phraseology) in Great Britain £5,294,870 6 104

Net Produce.

Land-Tax on Lands and Tenements.... £1,184,790 12 5f

ASSESSED TAXES.

Schedule. 128,848 11 7 77,539 4 Ilf 19,019 9 5f 937 19 0 14,581 9 1 4,651 12 3 29,047 14 4* 963 16 10 16,337 14 0 27.769 2 II/ 2,050 10 7 34,726 18 3 24,270 12 11 244 12 0 4,493 18 10 12,010 18 0 11,696 0 0 3,730 0 0 • 1,000 0 0 1,420 0 0 15 3 6 1,209 10 51 A. Windows 1,195,293

7

101 B. Inhabited Houses 1,361,625 0 54 C. Servant. 995.087 5 6 D. Carriages 397,613 10 0 E. Horses for Riding 362,675 9 0 F. Other Horses and Mules 69,459 8 0 G. Dogs . . . 186,102 2 0 H. Horse Dealers 15,045 8 (/ I. Hair Powder 15,947 5 6 K. Armorial Bearings ..... ..... 54,745 10 0 L. Game Duties 142,158 4 4 Composition Duty 28,093 2 0 Penalties on Arrears levied by the Barons of the Exchequer in Scotland 874 4 11 £5,292,491 10 0* Property Duty 2,378 16 10 £5,294,870 6 10f

The whole of the above are taxesupon property. The first two fall upon • rent, the others upon the income of the wealthy. We propose retaining the whole, but consolidating the House and Window duties.

It will be seen that Ireland is exempted from direct taxes, as she was exempted from the Property-tax. The reason will be sought in vain. There may be valid grounds for exempting a poor country from duties upon articles of consumption ; but income, arising from property, is really more valuable (will go farther) in a poor country than in a rich one. Why, then, this partiality ? Because Ireland was in reality, until lately, a 'close borough. The owners of counties and the owners of corporationscom- bined together to exact the last farthing from their poorer countrymen, and to throw the burden of maintaining them, and supporting the neces- sary public establishments, upon Great Britain. This is a subject re- quiring early attention. The gentry of Ireland must shortly be sub- jected both to taxes and Poor-Laws.

POST-OFF ICE.

(R.)-Prodnce of the Post-Office Establishments

of the United Kingdom . £2,212,206 5 71

GREAT BRITAIN. Net Produce.

Unpaid Letters outwards (i. e. into the Country). and paid Letters inwards (from the Country), and Ship Leiters, Sic. charged on Country Postn a:sten. Unpaid Letters inwards (L e. from the . Country), anti paid Letters outwards IP644,372 9 5a (into the Country), collected by the Letter-carriers, Sec. in London and Edinburgh . ......... Bye and Cross Road Letters . Twopenny and Penny Post Letters, at Loudon and Edinburgh .. 118,200 14 7 Letters charged on the Postmasters in the West Indies and British North America 48,420 16 111 Foreign Letter.Carriers, Window-Money, &c. 199,374 10 3 Passage-Money, and Freights by the Packets 51,797 1 8 Miscellaneous, including 5,542L Ss. 32d. balances to late Postmasters and others, unclaimed from 1689 to 1824 9,545 16 2a £1,982,211 9 11

IRELAND. Gross Receipt.

Postage on Letters from Great Britain and the country parts of Ireland for de-

livery in the City of Dublin. . £66,711 15 7 Postage on General and Post-paid Letters,

charged against the Deputy Postmasters 91,651 13 Fla Postage on Bye and Cross Road Letters, charged against the Deputy Postmasters 57,123 17 2 Postage on Letters Post-paid at Dublin, for Great Britain and the country parts,

of Ireland, and foreign parts 24.437 8 11 Penny and Twopenny Postage • 4,670 12 9

Postage received for Letters returned to the Dead Letter Office, and from thence

delivered to the Public ..... ........... 115 16 1

Postage received for Expresses 0 8 2 Miscellaneous Receipts 2,995 7 5/ £247,711 19 10

Repayments-

Postage on re-directed, dead, unknown,

refused, overcharged Letters, &e. 17,717 3 41 Net Produce £229,994 16 51

Amount of Postage in Great Britain brought down.. 1,932,211 9 11 £2,212,206 5 7/

Some persons have recommended a reduction of the rate of postage on letters, with the view of increasing its produce. It might probably be beneficial. An inquiry into the expenditure and abuses of the establishment would certainly be so. The privilege of franking is much abused. As the practice scarcely admits of regulation, it should be abolished.

MISCELLANEOUS.

(S.)-Miscellaneous Branches of Revenue, producing i: 545,060 12 44 DUTIES ON SALARIES, OFFICES, AND PENSIONS.

Net Produce.

Duty of One Shilling in the Pound on 'Salaries and Pensions £14,138 16 8 Duty of Sixpence in the Pound on Offices and Pensions ....... 7,283 13 5 Duty of Four Shillings in the Pound on Offices, Pensions, and Duty on Personal Estates .. 30,929 6 9/ £52,351 16 10/

HACKNEY COACHES, AND HAWKERS AND PEDLARS. Hackney Coaches, Chariots, and Car-

riages with two wheels (Cabs?) £63,136 10 0

Hawkers and Pedlars in England 33,733 9 9

Scotland 1,956 0 0

£67,925 19 9

Sir H. PARNELL proposes the abolition of the above on the grounds of partiality in their operation, and expense in the collection.

WOODS, FORESTS, AND LAND REVENUE. Amount collected by the Receivers in England. Wales, and Ireland ; in Alder-

ney and the Isle of Man. £218,815 14 8/ ,Amount arising by Rents not included in the Receivers' Accounts 11,234 12 11

Amount arising by Fines 18,085 10 6

Amount arising by Sales or Exchanges of Crown Lands; by Sales of Old Materials, by Charges on the preparation of Crown Leases; by Repayment of Monies ad- vanced for Surveys, and for Auditors'

and Docket Fees 76,020 0 4 Amount arisen by Sales of Bark, Timber, and offal Wood of the Royal Parks and Forests; Gale Rents, and Rents for the temporary occupation of Lands intended for Planting .. 39,586 1 10/ £363,742 0 4

The above branch of revenue has often been brought before the public ; and the sale of the pro- perty, and the total abolition of the office, frequently and properly recommended. It is pregnant with job- bing and profusion. We may probably return to the Subject. At present it may be enough to observe, that not one farthing of the above has reached the Exchequer. Small Branches of the King's Hereditary Revenue-

.Prte-fines £6,170 13 4-

Post-fines 481 16 4

Proffers 607 6 8 Compositions 0 6 8

E7,260 2 7

Surplus Fees of Regulated Public Offices. £44,684 3 9

Poundage Fees, Pells Fees, Casualties, Treasury Fees, and Hospital Fees, &c.. £9,096 9 I/

General Abstract of Miscellaneous Sources of Revenue-

Duties on Salaries, ............ £52,351 16 10/

Hackney Coaches, Hawkers, and Pedlars 67,925 19 9 Crown Lando 363,742 U 4 Small Branches of the King's Hereditary Revenue.... 7,260 2 7

Surplus Fees 44,684 3 9

Poundage Fees, &c .. 9,096 9 11 £545,060 12 41

General Abstract of Table I.

Customs £19,478,964 2 9 Excise 19.797,294 7 41-

Stamp Duties . 7.248,093 14 6

Taxes (i. e. Land and Assessed Taxes).. ...... 5,294,870 6 10/ Post Office 2,212,206 5 it

Miscellaneous 515,060 12 41 Deduct Duties repealed. Customs.

Coal, Culm, and Slates, headed I in

Tables £993,872 18 a Excise.

Beer, Printed Calicoes, and Oil Cloths, Leather, Cyder, and Perry, ditto 3,059,176 18 81 4,053,049 16 111

£54,576,479 9 5k

Grand Total £50,523,429 12 6*

TABLE III.

Approximate Calculation, in round numbers, of the from Property.

ENGLAND.

Rents of Houses and Lands, including Tithes, &c £41,000,000 Canals, Docks, Railroads, &c 6,000,000

Annuities, Dividends from Insurance Offices, and other Public Companies £8,000,000 But as much of this description of Property arises from Funds,

and some from Mortgage, deduct 5,500,000 Dividends from the Public Funds

IRELAND.

Rents, including Glebe Lands, Stc.

Of this supposed to be Absentees, £6,000,000 Tithes SCOTLAND.

Rents 0 0 •

Income arising

2,500 000

28,500,000 14,000,000 2,000,000 6,000,000 £100,000000,

Previous page

Previous page