MONEY MARKET.

STOCK EXCHANGE, FRIDAY AFTERNOON.

The market for English Stock has been firm since our last; and up to yes- terday afternoon the business transacted in Consols had not been extensive. Just previous to the close of business, the determination of the Opposition not to oppose the granting the Supplies, became known in the City, and an im- provement in price was the consequence. Consols have risen further during the day, and close this afternoon at 924 for the Account. Money continues abundant. The principal business of the week has, however, been confined to Spanish Bonds and Scrip; both of which have been in demand at considerably improved prices. The rise in the Codes Bonds has been much greater than that which has occurred in the Scrip of the new loan ; the former having risen more than 2 per cent. since Saturday last, while the improvement in the latter has not exceeded i per cent. This inequality has chiefly been produced by the demand which has arisen for the Deferred and Passive portions of Cortes Bonds, and by the purchases of the Bonds themselves, which have been effected on Dutch and French Account. The price of the Passive and Deferred Stocks Las consequently risen' greatly here ; the Passive having been to-day at 18 per cent. and closing at I 7i, and the Deferred 26i. The price of the Cortes Bonds has been as high as 62ti, but closes lower, viz. 62h. The highest quotation of

the Scrip has been 7j, and the closing price is 7d The Dutch, Russian, Belgian, and other European Continental Stocks, continue in demand at higher prices. Columbian Bonds have also been sought after to-day, and have been as high as 39; but close lower. We do not believe that this impulse is traceable to the receipt of any intelligence from South America ; but are inclined to refer it to some proceedings which are, we believe, now going on in Madrid, con- nected with the recognition of the Transatlantic Republics by Spain.

Several new adventures in Mining and Railroads have been introduced, or are about to make their appearance in the market. The rage for joint stock speculation, which rendered the year 1825 so fatal an tem, shows a tendency to revive—though kept in check by the state of our home politics. The grand difference between the proceedings of that year and the present seems to be, that most of our schemes are of a domestic nature, and that the spirit of speculation, although quite as active, has not yet acquired the recklessness by which it was characterized at that period.

SATURDAY, TWELVE o'cnocx. The transactions in English Stock have been lew and unimportant. Spa- nish Bonds still continue in demand, from the circumstance of the purchases of Deferred and Passive Stocks continuing. Deferred Stock is quoted at 27} 28, and Passive 18. Nothing worthy of remark has occurred in the other Foreign Bonds ; the attention of the dealers' brokers being much occupied in preparing for the settlement of the Account, which will take place on Monday.

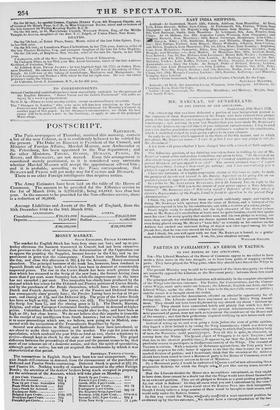

3 per Cent. Consols

Ditto for Account

New 34 per Cent. Annuities

nt Bank Stock forAccou India Stuck for Account Exchequer Bills Belgian 5 per Cents Brazilian 5 per Cents Danish 3 per Cents 92/ f 921 1001. 225 260

30333 103

S5.1. Dutch 2i per Cents.

French 3 per Cents Greek, 18:c3.5 per Cents Mexican 6 per Cents.

Portuguese 5 per Cents , Do. Regency Serip,5per Cent Rusgia0, 11.22, 5 per Cent

Spanish, 15121, 5 per Cent Ditto New Scrip 561

-

411

11 a 923 ,03 1,:aiiery323..d. 6.21 j

Previous page

Previous page