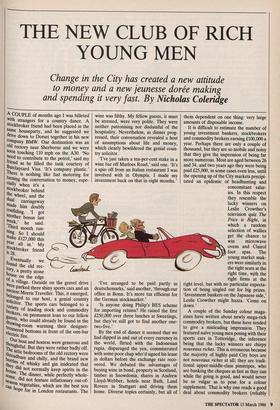

THE NEW CLUB OF RICH YOUNG MEN

Change in the City has created a new attitude to money and a new jeunesse doree making

and spending it very fast. By Nicholas Coleridge

A COUPLE of months ago I was billeted With strangers for a country dance. A stockbroker friend had been placed in the same houseparty, and he suggested we drive down to Dorset together in his new

longed to our host, a genial country solicitor. The sports cars belonged to a nrietY of leading stock and commodity urokers, on permanent loan to our fellow rests, who could already be found in the jawing-room warming their designer-

Use. bottoms bottoms in front of the one-bar electric fire.

Ciur host and hostess were generous and 4,t,°ughtful. But they were rather badly off. :`,ne attic bedrooms of the old rectory were loreadbare and chilly, and the brand new roottles of whisky and gin inidcated that hneY did not normally keep spirits in the So me The dinner, while perfectly whole- se' did did not feature inflationary out-of- oil vegetables, which are the best you atl hope for in London restaurants. The

wine was filthy. My fellow guests, it must be stressed, were very polite. They were neither patronising nor disdainful of the hospitality. Nevertheless, as dinner prog- ressed, their conversation revealed a host of assumptions about life and money, which clearly bewildered the genial coun- try solicitor.

I've just taken a ten-per-cent stake in a wine bar off Marloes Road,' said one. 'It's a spin off from an Italian restaurant I was involved with in Olympia. I made my investment back on that in eight months.'

'I've arranged to be paid partly in deutschemarks,' said another, 'through our office in Bonn. It's more tax efficient for the German stockmarket.'

'Is anyone doing Philip's BES scheme for importing retsina? He raised the first £250,000 over three lunches at Sweetings, but they've still got to find another one- two-five.'

By the end of dinner it seemed that we had dipped in and out of every currency in the world, flirted with the Indonesian rupia, disparaged the yen, commiserated with some poor chap who'd signed his lease in dollars before the exchange rate reco- vered. We debated the advantages of buying wine in bond, property in Scotland, timber in Snowdonia, shares in Andrew Lloyd-Webber, hotels near Bath, Land Rovers in Stuttgart and driving them home. Diverse topics certainly, but all of them dependent on one thing: very large amounts of disposable income.

It is difficult to estimate the number of young investment bankers, stockbrokers and commodity brokers earning £100,000 a year. Perhaps there are only a couple of thousand, but they are so mobile and noisy that they give the impression of being far more numerous. Most are aged between 26 and 34, and two years ago they were being paid £25,000, in some cases even less, until the opening up of the City markets precipi- tated an epidemic of headhunting and concomitant salar- ies. In this respect they resemble the lucky winners on Leslie Crovvther's television quiz The Price is Right, in which a random selection of wallies get the chance to win microwave ovens and Clairol A couple of the Sunday colour maga- zines have written about newly mega-rich commodity brokers, but these have tended to give a misleading impression. They featured naïve young men posing with their

sports cars in Totteridge, the inference being that the lucky winners are chirpy nouveaux riches. This is erroneous because the majority of highly paid City boys are not nouveaux riches at all; they are tradi- tional upper-middle-class pinstripes, who are banking the cheques as fast as they can while the going is good, and would never be so vulgar as to pose for a colour supplement. That is why one reads a good deal about commodity brokers (reliably contingent in Japanese or American banks like Manufacturers Hanover, Bankers Trust, Morgan Guaranty and Merrill Lynch, or stockbrokers and jobbers like Rowe and Pitman, Grieveson Grant and Wedd Durlacher, where serious money is being distributed among the deserving young.

Money is the new club. In the early years of this decade it was narcotics that pro- vided the focus and conversation for the aimless young rich. Now their more re- sponsible and industrious cousins (some of whom felt rather left out during the drugs era, working away in their dull City offices) have a club of their own. Membership qualifications: a large salary, minimum £75,000. Club benefits: lively complacent conversation about tax avoidance, accoun- tancy fees and how to spend what's left.

Spending it is rather a poser. A strange characteristic of almost all these young men is that they are not saving much. Cer- tainly they are contributing to pension and life insurance schemes, but there is little evidence of capital accumulation, anyway in shares. Because they were not penniless in the first place, they often already own their house or flat. Their car, of course, is on the firm, as are their restaurant bills (regardless of whether they're entertaining clients or girlfriends), so there is no ob- vious stay on their cash flow. Consequently there are bags of surplus income to spend on holidays, paintings, wine and furniture. On the other hand, time is at a premium. The working day in the City, especially if you trade on the New York or Tokyo markets, has grown longer and longer. Twelve-hour days are commonplace.

0 ne 30-year-old investment banker reckons that, on an hourly basis, he works two-and-a-half times harder than his father ever did in the same firm. (The son is paid 11 times more in real terms.) Month after month of arriving at the office by 7.30 a.m. and leaving at 8.00 p.m. makes him feel permanently exhausted. Every evening after work he drinks a whole bottle of claret in a City wine bar, before setting off home for pre-dinner whisky. Because he is paid so well, and what the hell, he never orders wine costing less than £17 a bottle. He takes four holidays a year of one week each, which is the longest he feels able to get away, always abroad: skiing, the Caribbean, Nepal, Morocco. Because he never knows until the last minute when he'll be able to go, he cannot buy Apex tickets, so air fares cost far more than they need. Because he's away for such a short time, he takes care to stay only in expensive hotels.

It would be wrong, however, to imply that young investment bankers are philistine. On the contrary, their backgrounds have often equipped them to spend with discrimination. Their holidays are enterprising: short assaults on Ladakh, visiting monasteries in Sinai, a week in Burma. They have a tendency to try to fit two destinations into one holiday, especially if this involves complicated and extravagant ticketing. They like to spend money on watercolours, Indian miniatures and African tribal masks. They give good parties.

The creation of all this new money is attracting resentment. Not from socialist sources (who are only beginning to grasp the scale of what's going on) but from the young men's contemporaries outside the City. Historically, of course, City jobs have always been better rewarded, because they are dealing in raw money. People in less well-paid professions like auctioneering, land agency and the wine trade did not really mind the discrepancy, because they knew that their own jobs were both more fun and more glamorous. Now this prejudice is being challenged. The new young rich have highlighted the plight of the educated, middle-class poor. A junior expert at Christie's, aged 27 with an Oxbridge degree, may earn £8,500. His City flatmate, quite probably stupider, may earn £116,000. Only a deeply philosophical or insane person could avoid a rush of panic and jealousy. Perhaps the Christie's expert should console himself by advising his richer friend on the formation of his picture collection. More likely he is indignant that the City boy is not only in a position to collect something he knows nothing about, but is also absolved from all future anxieties about paying school fees, when that moment arises. The bursar at a leading public school has remarked how surprised he is at the ease with which certain middle-class families are able to pay the fees out of income, while others are struggling more than ever, desperately spending capital. The difference, of course, lies in their choice of profession. One 34-year-old stockbroker claims to have made more money in the last six years than his father made in his entire career as a distinguished estate agent. I can think of several families that struggled a bit to put their children through public school, onlY to find that eight years later their standard of living is considerably lower than that of their sons. 'We only drink decent wine these days when we visit Benjy in Battersea,' moans one elderly sherrY importer. 'He arrives back from his work with a carrier bag full of splendid claret. Shocking waste, because there's no time to let it breathe.'

More irritating still for the under-paid is the vogue for Business Expansion Schemes. Even I, with no inflated city income, am sent half a dozen prospectuses a month, inviting me to invest £5,000-20m00 in new restaurants, wine. clubs, theme parks and bloodstock agencies. These apparently tax-efficient enterprises have been catching on at such a rate that half the people I know seem to have a stake in one scheme or another. The vast majority of investors are, of course., from the City. Their motive, I suspect, Is not tax relief but a glamorous topic of conversation. At dinner parties these days, boys are forever inviting girls to visit 'their restaurant or try a glass of 'their' wine fro.111 'their' vineyard. Only later in the evening do they casually mention that, as well as being a partner in San Fellini's, they are also a junior director at Shearson Lehman' The only good news, for those of us outside the winner's enclosure, is that the huge salaries will not last. They are largelY contingent on performance and it seals unlikely that sufficient new business Willbie generated to justify the millions of pounos in overheads to set up quite modest. operations. 'They're going to have to sweat to ratify their positions,' said an analYst last week's Financial Weekly, cheerfill.1 jumbling his metaphors. 'Unless the profits roll in, the screws will really be on.' S°111e commentators give the boom three yeall; others five to seven. After that we can lo°' forward to a levelling (unless dt,Ae Government does it first; there is vinive pre-Budget talk of supertax for Pe°P1 earning more than £100,000). HOW to young market makers will adjust reduced circumstances is hard to prechei: Probably, by then, their wine bar venture! will be producing enough revenue t° cushion the fall.

Previous page

Previous page