MONEY MARKET.

STOCK EXCHANGE, FRIDAY AFTYRYOOX

At the usual weekly meeting of the Bank Directors, held yesterday, it we determined to increase the rate of discount to 5/. per cent.; and accordingly a notice to that effect was made public. As the adoption of this measure had for some time been considered probable, it did not produce the slightest effect upon the price of the Public Securities. The amount of the whole circulation of hank-notes will hardly be diminished by this proceeding, but rather the contrary ; as the augmented value given to money will call into action aeon- sidemble portion of the deposits now in the Bank, which will be thus converted into bank-notes ; and while a decrease of the amount of the Bank liabilities under the head of Deposits will be effected, there will be an increase of them under that of circulation. The amount of Deposits in the Bank has decreased steadily since the beginning of the year. In January they were 10,315,00014 and the last statement gave them at 8,107,0001.; showing a decrease of 2,208,0001 During the corresponding period, the Circulation has been very equable, the variation ill it not having exceeded 170,000/. It follows, that the Directors, ui their exertions to regulate the circulation, have actually recalled nearly the whole 2,208,000/. added to it by the withdrawal of deposits to that extent during the last few months. This they have accomplished by means of the sale of Exchequer Bills and other Securities. The stock of Bullion has decreased during the same period 3,313,0001. ; and the Securities have been augmented to the extent of 1,432,000/. The circulation has been increased 149,0001. Vie

therefore find that the whole of the deposits have been drawn away in bullion, is will appear by the subjoined figures.

Dr. Cr. By amount of Deposits with- To diminished amount of Bid. n in store, as compared me drawn in the snub period £2,208,000 lio • with statement in Jan. last. £3,313,000 By increase of Securities 1,432,000

To increase of Circulation— . 149,000

178,000 • Balance • 43,640,000 £3,640,000 If the balance, as shown above, viz. 178,000/., be deducted from the amount of Deposits withdrawn, it will show the actual state of fir: case : it results from these figures that the deposits have in reality been all token away in bullion, as the 178,000/. can easily be accounted for by supposing that the profit of the business over and above the amount requisite to pay the April Dividend has during four months amounted to that sum. It seems apparent, therefore, that the Directors will not stop the drain of bullion by the present measure; and that to do so effectively, they must proceed to some other mode of curtailing their liabilities.

The effect produced upon the Money-market has been unimportant. Con- sols for Account and Money are to-day at the same prices they were yesterday. Exchequer Bills have been done as low as 32; to which quotation they had fallen on Wednesday. In the Foreign Market, the only change of importance has been in Spanish Stock; to which the extinction of the hope of a Timms Ministry in France has given a severe blow : the price was yesterday as low as 18i, but has to-day advanced. to 19li at which quotation the market is feeble.

SATURDAY, Twet.vz o'Cr.oen.

Scarcely any business of importance has occurred this morning, and prices are the same as yesterday. The Spanish Market is rather firmer, in conse- quence of the intelligence of the capture of Ramales. The South American Securities are rather firmer : there is demand for Chilian Bond at 233- for Co- lumbian at 31, and Mexican at 26.

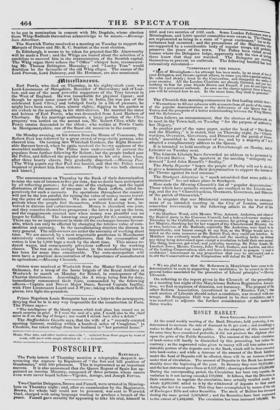

3 per Cent. Como!s Ditto for Account 3 per Cent. Reduced.. New 31 per Cent. Aims. Bank Stock India Stock Ditto Builds Exchequer Bills

Belgian 5 per Cents

931 1 931 4 921 1001 105 — — 32 4 102 1 Brazilian 5 per Cent • Danish 3 per Cents Dutch 21 per Cents

Portuguese Regency Spur Cts.

Ditto 3 per Cents Russian (1822) 5 per Cent Spanish (1835) 5 per Cent.. , . 112ferred Stock Passive Ditto

781 751 561 351 6 211 2 113 191 81 1 44 I.

Previous page

Previous page