BIGGER THAN THE BIG BANG

The change in Stock Exchange rules next week

has made a noise outside the City. Tim Congdon compares

it to an even louder explosion that has hit London

THE Big Bang in the City is a rather unusual explosion in having made a great deal of noise before it has happened. Such has been the volume of anticipatory sound that people are talking about Big Bang offices, Big Bang housing developments in Docklands, rival Big Bangs in Fleet Street and publishing, and, of course, Big Bang salaries. Unfortunately, the cacophony of hype has not made it any easier to understand the significance of the changes in the Stock Ex- change rule book which will take effect on 27 October. In fact, the importance of the Big Bang has been exagger- ated. It is a sideshow to, indeed almost a by- product of, a much Big- ger Bang which has transformed interna- tional finance over the last 25 years.

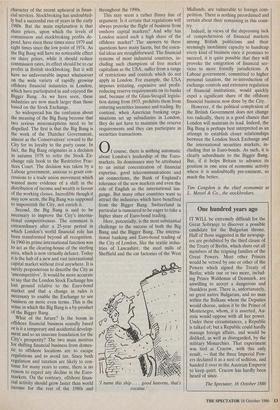

The Bigger Bang has two main dimen- sions, the rapid growth of offshore (or Euro-) financial transactions and the tendency for the City of London to capture the lion's share of the associated business. (The offshore markets are also known as Euro-markets, for reasons which are rather obscure, since they are not specifically European.) Offshore financial activity is a relatively recent innovation and is not easy to define. Roughly speaking, it can be regarded as the result of lenders and borrowers deciding to lend and borrow outside their own countries, to meet in a jurisdiction which is not home for either party. Thus, when a wealthy businessman from the Middle East leaves money on deposit with a bank in London and the bank lends to a French or German com- pany, it is clear that these are all offshore transactions. But it is not clear that the same can be said when an American multinational leaves money on deposit with a bank in London and the bank lends to another American multinational.

Most of the data do assume that the second example, like the first, consists of offshore transactions. If some inevitable arbitrariness of this kind is accepted in the definition, the vast scale of the Bigger Bang relative to the Big Bang soon be- comes obvious. Offshore financial business takes two principal forms, banking and securities operations (issuing, trading and so on). The volume of both can be con- trasted with the level of transactions on the Lon- don Stock Exchange.

Banking business can be measured by the amount of Eurocurrency deposits. In March 1986 they were almost $3,500 billion. At present the total capitalisation of equities on the London Stock Exchange is roughly £275 billion (under $400 billion), while the national debt stands at about £130 bil- lion ($180 billion). Evidently, much more money has been com- mitted to Eurocurrency deposits than invested in British stocks and shares.

But this is rather un- fair, as the Stock Ex- change does not consist of banks and its mem- 4'6w bers do not (with some exceptions) solicit de- posits. To compare like with like, we should look at the value of Euro-securities now being traded. It has been estimated that last year the turnover in the Euro- bond market was between $1,500 billion and $2,000 billion, while that on the Stock Exchange was, at $600 billion, less than half as much. The difference is even greater if we compare the flow of new issues, rather than the volume of dealing in existing securities. The data demonstrate very decisively just how unimportant the Stock Exchange, in relative terms, has become. In 1985 the total amount of money raised on international markets was $256.5 bil- lion, according to figures prepared by the Organisation of Economic Co-operation and Development. About 80 per cent of this was raised by the issue of securities, with the remainder accounted for by bank loans. So the flow of new securities coming onto the market was over $200 billion a year, equivalent to about $800 million each working day. By contrast, the London Stock Exchange raised just over $8 billion in 1985, equivalent to a little more than $30 million each working day.

It should be emphasised that the emerg- ence of enormous offshore financial mar- kets is quite recent. In the mid-1950s, Eurocurrency deposits barely existed. They became possible, in significant amounts, only after the restoration of dollar convertibility for non-residents by ten European governments in 1958. Inter- national securities business is very old and can be dated back to mediaeval times, if not before, but the latest surge in activity is altogether unprecedented in scale. In the 1950s, foreign borrowers may have raised at most one or two billion dollars a year in international capital markets, with the bulk of it from New York. The first spate of Euro-bond activity was in the early 1970s. In 1972 and 1973 international bond issues totalled $11.2 billion and $10.0 billion respectively. Fast growth followed throughout the 1970s and in 1980 the figure for new issues was nearly $40 billion. By then London had become the foremost centre.

But the most spectacular phase of expan- sion, the coda of the Bigger Bang, came in the early 1980s. The onset of the debt crisis implied serious, if as yet largely unrealised, losses for the international banks. As a result they no longer had the capital resources, the inclination or the ability to support the same fast growth in their balance sheets as in the 1970s. Business was transferred away from them towards the securities houses. (This transfer of business passes by the rather ugly neolog- ism `securitisation'.) In 1983 total issues of Euro-securities were more than double their 1980 level, at over $80 billion. The final sprint to the 1985 figure of over $200 billion was even more rapid.

Because of this boom, an extraordinary situation has arisen where the Euro- market, which has no physical embodiment in an exchange building or even a widely recognised set of rules and regulations, is the largest source of capital in the world. In some senses the business belongs to no country, since it involves intercontinental flows of funds and cross-frontier com- munications. The term 'offshore' is never- theless rather misleading in its suggestion that something important happens just off coastlines. Instead, as with all work gener- ated by financial markets, the major opera- tions are conducted very much on terra firma. Although some offshore transac- tions are conducted on small tropical is- lands whose status as terra firma could be debated, most of the significant work is completed in large financial centres. Of these, London is clearly dominant.

In effect, therefore, London has become host to the greatest and most rapidly growing capital market in the world. It is this development, not the forthcoming changes in the Stock Exchange rule book, which explain the telephone-number in- comes, the boom in office building in EC2 and the proliferation of wine bars offering champagne and smoked salmon for break- fast, with an up-to-the-minute Telerate screen in the background. Although there are only a few thousand Euro-bond traders in London, the impact of the offshore financial revolution has been much wider than the mere dealing in securities. There are obvious spin-offs for foreign exchange dealing and money broking, but the be- nefits also spread outside the purely finan- cial area.

As every transaction has a legal and corporate finance aspect, the increase in business has strengthened the demand for the services provided by lawyers, accoun- tants and company treasurers. Because expertise on the various instruments is concentrated in London, the Euro-boom has given a further fillip to the fund management industry. When multination- als and foreign governments need advice on how to make their next issue, and when well-off individuals want recommendations on their bond portfolios, they must visit London, which means at least a plane flight and a stay in a hotel and could also lead to a shopping trip in the West End. In short, the Bigger Bang is one of the main reasons for the current prosperity not just of the City, but also of the rest of London, and, indeed, of the South-East of England.

Britain's leadership in international financial services in just as complete as Japan's in consumer electronics or the USA's in the aerospace industry. There are some inevitable difficulties defining the location of offshore financial business, because it is intrinsically cosmopolitan, but some figures are available. According to Bank of England data, Britain's share of Eurocurrency lending was 31 per cent at September 1985, compared to 11 per cent for Japan and 8 per cent for France, the nearest rivals. Daily turnover in foreign exchange is estimated to run at about $90 billion in London, far ahead of $50 billion in New York and $48 billion in Tokyo. London also has more foreign banks than any of the other centres, with a recent count indicating that it had 399, while New York had 254 and Tokyo only 76.

When newspaper commentators attri- bute the evident, indeed the perhaps all too conspicuous, affluence of the City to the Big Bang, they have misunderstood the character of the recent upheaval in finan- cial services. Stockbroking has undoubted- ly had a successful run of years in the early 1980s. But the main explanation is that share prices, upon which the levels of commission and stockbroking profits de- pend, have risen three times since 1979 and eight times since the low point of 1974. As the Big Bang will have no noticeable effect on share prices, while it should reduce commission rates, its effect should be to cut profits in British stockbroking. But it will have no unfavourable impact whatsoever on the wide variety of rapidly growing offshore financial industries in London, which have participated in and enjoyed the Bigger Bang. As we have seen, these industries are now much larger than those based on the Stock Exchange.

So widespread has the confusion about the meaning of the Big Bang become that two serious misconceptions need to be dispelled. The first is that the Big Bang is the work of the Thatcher Government, almost as the Conservatives' reward to the City for its loyalty to the party cause. In fact, the Big Bang originates in a decision in autumn 1978 to refer the Stock Ex- change rule book to the Restrictive Prac- tices Court. The decision was taken by a Labour government, anxious to grant con- cessions to a trade union movement which wanted more evidence of a shift in the distribution of income and wealth in favour of the working classes. Incredible though it may now seem, the Big Bang was supposed to impoverish the City, not enrich it.

Second, the Big Bang is said to be necessary to improve the City's interna- tional competitiveness. The comment is extraordinary after a 25-year period in which London's world financial role has been transformed beyond all recognition. In 1960 its prime international function was to act as the clearing-house of the sterling area, which is now virtually defunct. Today it is the hub of a new and vast international capital market without rival anywhere. It is surely preposterous to describe the City as 'uncompetitive'. It would be more accurate to say that the London Stock Exchange has lost ground relative to the Euro-bond market and that a change in rules is necessary to enable the Exchange to see business on more even terms. This is the sense in which the Big Bang is a by-product of the Bigger Bang.

What of the future? Is the boom in Offshore financial business soundly based or is it a temporary and accidental develop- ment and so an insecure foundation for the City's prosperity? The two main motives for shifting financial business from domes- tic to offshore locations are to escape regulations and to avoid tax. Since both regulation and taxation are likely to con- tinue for many years to come, there is no reason to expect any decline in the Euro- markets. On the contrary, offshore finan- cial activity should grow faster than world income for the rest of the 1980s and throughout the 1990s.

This may seem a rather flimsy line of argument. Is it certain that regulations will always provoke the flight of business from onshore capital markets? And why has London seized such a high share of the offshore market? The answers to these questions have many facets, but the essen- tial ideas are straightforward. The financial systems of most industrial countries, in- cluding such champions of free market capitalism as the USA, suffer from a range of restrictions and controls which do not apply in London. For example, the USA imposes irritating, expensive and profit- reducing reserve requirements on its banks and, because of the Glass-Steagall legisla- tion dating from 1933, prohibits them from entering securities issuance and trading. By contrast, when American banking orga- nisations set up subsidiaries in London, they do not have to maintain the reserve requirements and they can participate in securities transactions.

0 f course, there is nothing automatic about London's leadership of the Euro- markets. Its dominance may be attributed to an initial concentration of financial expertise, good telecommunications and air connections, the Bank of England's tolerance of the new markets and even the role of English as the international lan- guage. But many other countries want to attract the industries which have benefited from the Bigger Bang. Switzerland in particular is rumoured to be eager to take a higher share of Euro-bond trading.

Here, potentially, is the most substantial challenge to the success of both the Big Bang and the Bigger Bang. The interna- tional banking and Euro-bond trading of the City of London, like the textile indus- tries of Lancashire, the steel mills of Sheffield and the car factories of the West 'I name this ship. . . good heavens, that's cocaine.' Midlands, are vulnerable to foreign com- petition. There is nothing preordained and certain about their remaining in this coun- try.

Indeed, in views of the depressing lack of comprehension of financial markets among British politicians and their seemingly inordinate capacity to handicap every kind of business once it promises to succeed, it is quite possible that they will provoke the emigration of financial ser- vices to more friendly jurisdictions. A Labour government, committed to higher personal taxation, the re-introduction of exchange controls and extensive regulation of financial institutions, would quickly expel a significant share of the offshore financial business now done by the City.

However, if the political complexion of the British Government does not change too radically, there is a good chance that London will maintain its lead. Indeed, the Big Bang is perhaps best interpreted as an attempt to establish closer relationships between the London Stock Exchange and the international securities markets, in- cluding that in Euro-bonds. As such, it is clearly subordinate to the Bigger Bang. But, if it helps Britain to advance its position in one area of economic activity where it is undoubtedly pre-eminent, so much the better.

Tim Congdon is the chief economist at L. Messel & Co., the stockbrokers.

Previous page

Previous page