Investment Notes

By CUSTOS

TM weekend change in the market atmosphere has been electrifying. The 9.2 jump in the index last Friday suggested that the market was assuming already that the Labour government had been defeated. Inevitably prices came back at the beginning of this week but a dangerous optimism still prevails. I suggest that caution is required, particularly in the steel share market. It is too soon to assume that the steel nationalisation Bill, which is timed for end- February. will be scrapped. If Mr. Wilson intends to hold his party together he will obviously have to make a show of introducing the Bill which he has promised, although it may not be as far- reaching as it was planned. Another group which has attracted some speculative attention is property shares. The prospect of a land com- mission to take over all development land may have been dimmed by the new political situation, but it should be borne in mind that the corpora- tion tax may force many property companies to reduce their dividends and that those with a large preference capital will be badly hit. Insurance shares still seem to be unattractive, for they have to get out of their own financial wood as well as the political one, but oil shares should return to more favour. It is hard to see how the Government. if it stays in office, can avoid having to make the oil companies some concession in regard to their overseas tax.

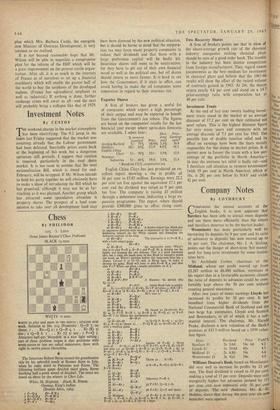

Exporter Shares A firm of brokers has given a useful list of companies which export a high percentage of their output and may be expected to benefit from the Government's tax rebate. The figures are based on the companies' results for the last financial year except where up-to-date forecasts

are available. I select four: Diet- Price-

% turnoVer dead Earnings exported Price yield ratio*

Aveling-Barford 5/- 75% 18/10} 5.3% 10.4 Distillers 10/- 50% 23/9 4.8% 14.3 English China Clays 5/- 70% 22/- 3.5% 12.0 Newman Industries 5/- 60% 19/6 3.0% 11.4

• Based on 371% corporation tax.

English China Clays has just produced an ex- cellent report showing a rise in profits of 36 per cent to £5.85 million. Earnings were 22.2 per cent tax free against the equivalent 17.1 per cent and the dividend was raised to 9 per cent tax free. The company is raising £3 million through a debenture issue, indicating a large ex- pansion programme. The export rebate should provide £300,000 gross to offset rising costs. Two Recovery Shares

A firm of brokers points out that in view of the above-average growth rate of the chemical industry companies making chemical plant should be sure of a good order book. The trouble in the industry has been intense competition from foreign manufacturers. They regard SIMON ENGINEERING as the best medium for investment in chemical plant and believe that the 1965-66 results will show the effect of the record volume of contracts gained in 1963. At 24s. the shares return nearly 4.6 per cent and stand on a 14.7 price-earnings ratio with corporation tax at 40 per cent.

Investment Trusts

At the end of last year twenty leading invest- ment trusts stood in the market at an average discount of 17.2 per cent on their estimated net asset values. This is the highest discount figure for very many years and compares with an average discount of 7.1 per cent for 1963 The possible loss of double taxation relief and its effect on earnings have been the fears mainly responsible for the slump in market prices. It is correct now to favour the trusts with a low per- centage of the portfolio in North America- in case the overseas tax relief is badly cut-and I therefore call attention to YEOMAN INVESTMENT (with 19 per cent in North America), which at 16s. is 281 per cent below its NAV and yields 41- per cent.

Previous page

Previous page