Pie in the sky

PORTFOLIO JOHN BULL

As I write, the equity market has steadied again at around 450 on the Financial Times ordinary share index after falling sixteen points on the new bank lending directive. That was, I sup- pose, the economic event of last week, but I am inclined to pay more attention to the excellent company results announced recently. Profits are rising pretty substantially this year—by 15 per cent in aggregate according to some estimates.

Having provided that general reassurance, I now turn with pleasure to Hoblyn Dix and Maurice's review of John Brown—in which I am a contented shareholder, having pur- chased 250 shares on 12 January at 27s 114. Hoblyn Dix say of John Brown that at 40s 'the shares of this company are underrated. The radical readjustment of the group that is currently taking place will justify a sharp up- ward revision of the market rating over the medium term. Accordingly, we recommend an investment in the company for substantial and sustained capital appreciation.' That . is very nice to hear—but I think it is important to watch these brokers' arguments right through.

They start with the shipbuilding side, which has been hived off into Upper Clyde Ship- builders. J. Brown has 30 per cent of the equity. Assuming that Upper Clyde can make 10 to 15 per cent on capital employed, say Hoblyn Dix, then J. Brown can expect a divi- den of f60,000 to £90,000. Well, much as I like the group as an investment, that is not an assumption I would care to make. The argu- ment concerning the steam-generating interests is the same—'in the early 1970s J. Brown could receive 5 per cent to 10 per cent on its capital'—on what evidence? There is none that I can find. Heavy losses are the order of the day at the moment.

On John Brown's chemical engineering and pipeline interests, I find myself more fully in accord with Hoblyn Dix. Constructors John Brown has got some useful North Sea pipeline orders. But the machine-tool interests are the key to John Brown's investment rating. Hoblyn Dix acknowledge that this side has been the mainstay of the group in the last three years and that although profits may fall this year they should go ahead quite strongly next year and the year after that. With that estimate I am in agreement. There is the 21.6 per cent holding in Westland Aircraft to take into account, which accounts for 16s 4d out of the share price.

Finally, Hoblyn Dix provide some profit estimates and asset calculations. On their figures, John Brown at 40s (the price is a little higher now) are selling at 25 times 1967-68 earnings, 12.4 times 1968-69 earnings and at as little as 7 to 8 times likely earnings in the early 1970s. They value the shares at 67s 8d, rising to 114s. With the shorter-term estimates I am in broad agreement. As for the early 1970s, we shall see.

Out of this there are two important points. John Brown is a reasonable purchase at its present price, though I shall not add to my holding. But, second, brokers' circulars must be viewed with a degree of scepticism especi- ally when conclusions depend upon guesses about periods three to four years hence. Un- fortunately this kind of exercise breeds a dangerous attitude to investment. John Brown is not a share which can confidently be left to mature until the early 1970s when—hey presto—the shares will be worth 80s. You must

follow the company week by week and make a rapid exit if events move unfavourably.

The bank restrictions, of course, have a particular bearing upon my holding in Barclays Bank. The shares have been weak since the announcement, indeed they have been drifting for some time. What ought to be observed, though, is that bank profits are chiefly deter- mined by the level of Bank rate. This year the average will be the highest it has ever been. Bank advances are limited to 104 per cent of their November 1967 level, which is, after all, a slightly improved level of business. Bad debts will continue at a high level, the usual concomitant of high Bank rate. And costs are moving up fairly sharply, though amalgama- tion and computerisation should help. I am, therefore, hanging on to Barclays Bank.

One additional question on Barclays. The City suspects more and more strongly that the Monopolies Commission will not allow the triple merger—Barclays-Lloyds-Martins—to go through. If I held Lloyds or Martins shares, this would worry me. But since Barclays is much the biggest of the three and in the posi- tion of the bidder, I make it, if anything, a bull point.

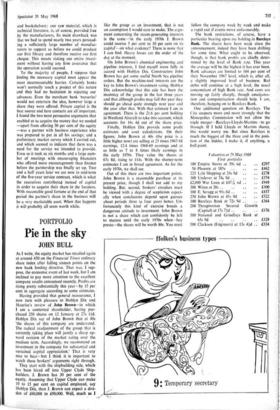

Valuation at 29 May 1968 First portfolio

100 Empire Stores at 59s 6d . • £297 50 Phoenix at 185s .. • • .. £462 225 Lyle Shipping at 24s 9d • • £278 100 Unilever at 74s 9d .. • • .. £374 £2,000 War Loan at £47A xd £949 300 Wit'an at 20s • • £300 100 E. Scragg at 91 s 6d .. • • .. £457 250 John Brown at 41s 9d • • .. £522 100 Barclays Bank at 72s 9d £364 200 Throgmorton Secured Growth (Capital) at 17s 71d .. £176 100 National and Grindlays Bank at 65s 9d £329 500 Clarkson (Engineers) at 13s 41d .. £334 60 Rio Tinto Zinc at 127s 6d .. £382 400 Associated British Foods at Its xr £239 'Cash with local authority at 71 per cent £535 £5,998 Deduct: expenses £122 Total £5,876 Second portfolio 100 Guardian Assurance at 38s 3d xd £191 40 Royal Exchange Assurance at 95s xd • • . . £190 300 Cambridge Instrument at 43s 94 .. £656 000 Brayhead at 13s £650 Oash in hand £3,479 £5,166 Deduct: expenses £34 Total £5,132

Previous page

Previous page