Investment Notes

By CUSTOS

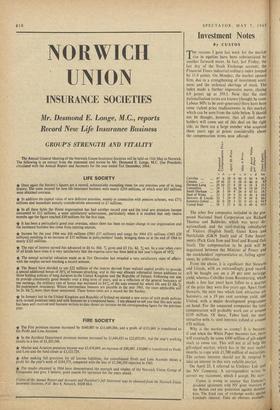

Mitt, reasons I gave last week for the market I rise in equities have been substantiated by another forward move. In fact, last Friday, the last day of the Stock Exchange account, the Financial Times industrial ordinary index jumped by 11.9 points. On Monday, the market opened firm, due to a strengthening of investment senti- ment and the technical shortage of stock. The index made a further impressive move, closing 6.9 points up at 359.1. Now that the steel nationalisation terms are known (thought by some Labour MPs to be over-generous) there have been some violent price readjustments in this market, which can be seen from the table below. It should not be thought, however, that all steel share- holders will come out of this deal on the right side, as there are a large number who acquired them years ago at prices considerably above the compensation terms now offered:

g

04 a Ti LITE.

ti..) N --... 4' t.c..)

s. d. s. d. s. d. s. d. Lm.

Colvilles 47 6 28 0 40 0 84 9 46.3 Conseil 19 10 15 6 18 0 46 0

9.9

Dorman Long ... 29 10 23 9 28 6 54 8 33.5 Lancashire 34 3 21 41 28 6 54 10 15.4 South Durham ... 26 3 19 9 24 0 47 11

18.2

Steel of Wales ... 32 5 19 9 26 0 48 4 64.8 Stewarts & Lloyds 32 5 29 9 33 0 49 0 80.2 Summers (John) 36 0 29 3 35 0 41 6

54.9

United Steel ... 38 3 27 6 36 6 49 6 95.6

The other five companies included in the pro- posed National Steel Corporation are Richard Thomas and Baldwins, which was never de- nationalised, and the steel-making subsidiaries of Vickers (English Steel), Guest Keen and Ncttlefolds (GKN Steel) and of Tube Invest- ments (Park Gate Iron and Steel and Round Oak Steel). The compensation to be paid will be negotiated between the Minister of Power and the stockholders' representative or, failing agree- ment, by arbitration.

From the above, it is significant that Stewarts and Lloyds, with an outstandingly good record, will be bought out on a 20 per cent earnings yield, whereas Colvilles (cum Ravenscraig, which made a loss last year) have fallen to a quarter. of the price they were live years ago. Apart front Stewarts, the next two which look attractive are Summers, on a 19 per cent earnings yield, and United, with a major development programme on hand. For the unquoted companies the total compensation will probably work out at around £110 million. Of these, Tubes look the most attractive with its steel interests valued at around £50 million.

Why is the market so strong? It is because, if and when the White Paper becomes law, there will eventually be some £600 million of gilt-edged stock to come out. This will not at all help the gilt-edged market, which has in the next twelve months to cope with £1,700 million of maturities. The serious investor should not be tempted to take an interest in this very volatile market. On April 23, I referred to Unilever Ltd. and the NV Company. A correspondent writes to correct my statement, which I accept. He says: Custos is wrong to assume that Unilever:s dividend agreement with NV gives investors In the British end any protection against devalua- tion. The fixed rate against

exchange works agal Limited's interest. Take an obvious example.

_ . .

,1

'

-iil E

. g

t.i `•

6

ra. s2 :5

;

. .. . NV pays 48 florins which at 12 to the £ equals £4. Britain devalues so that the £ is worth less. But the 12 to the £ continues to apply. So the dividend in f remains the same.

This agreement actually has the effect of de- stroying Limited's protection against devalua- tion. For example: Because of devaluation Limited's overseas offshoots earn more in £. Limited's profits rise relative to home-based industrials. But if it paid more in dividend. the Dutch end would have to get more.

Previous page

Previous page