FINANCE AND INVESTMENT

By CUSTOS

HAVING translated its relief at the Munich agreement into a spectacular rally in prices the Stock Exchange is now realising that " as you were " is not necessarily synonymous with standing at ease. The immediate political risk has been averted and that is an important item on the credit side of the investment equation ; but the long-term political risk is there, along with a number of awkward economic problems. Some, such as the course of American trade and its bearing on industrial trends over here, were with us before the crisis ; others, such as the prospects of Sir John Simon's second Budget next April and the relation of Mr. Chamberlain's hopeful forecasts of appeasement to our rearmament programme, have been precipitated by the crisis itself. Since nobody can do more than guess at the answers, who can wonder that neither investors nor specu- lators are rushing after stocks ?

I am not suggesting that the prospects of investment in the most general sense have not been improved by the Munich agreement ; except on the most pessimistic view of the political situation, they most certainly have. It is now possible, for example, to assess investment possibilities once again in relation to economic tendencies. Nor is it necessarily a bad thing that investors and business men are treading warily, since at this stage there are many reasons why they should. The real point is that despair has given place to hope. It now remains to be seen whether events will allow hope to develop into confidence and thus release the consuming power and enterprise which are being held back. Everybody, even the Prime Minister's severest critics, will hope that events will move in this direction, but I cannot yet recommend a bold policy in investment. At the same time, the sky is clear enough to justify a movement out of cash into the more respectable type of shares.

* * *

CZECHOSLOVAK BOND OUTLOOK

Two points of immediate interest to the City which have already emerged from the arguments at Westminster are. first, that rearmament is, for the present, to go full steam ahead (despite Mr. Chamberlain's no more war " assur- ances !) ; and, second, that the Czechs are to receive an advance of Lio,000,000 for " urgent needs." The re- armament decision, which is really not surprising, at least removes some of the market's worst fears for the near-term earring's prospects of a vast range of companies. In most instances the longer-term risks implied in arms-limitation are fairly well discounted in current share prices, but share- holders in some of the smaller companies whose earnings are almost entirely dependent on the defence programme will have to keep a wary eye on politics.

As for the Do,000,000 advance to Czechoslovakia, the City will not grudge this first instalment of the much larger loan which will be needed to help a dismembered State back on to its feet. Nobody can tell just yet what the total will be or whether other countries, such as France—and why not Germany ?—will lend a hand. Nor is it possible yet to assess Czechoslovakia's future power to cover her external debt service which, up to the present, has been met with exemplary promptness and regularity. Czecho 8 per cent. sterling bonds have risen from 57 to 6i on the strength of Britain's move, but the 13 per cent. yield measure, the market's doubts about the future. After all, you cannot wreck a nation's economic life and expect debt service on an 8 per cent. interest basis. Czechoslovakia will have to be given a good deal of money and a good deal of time.

FINE SPINNERS' SCHEME

If it is disturbing to find proposals such as the Fine Cotton Spinners' capital scheme still put before investors, it is also reassuring that nowadays opposition is so quickly mobilise.] and is usually effective. As I anticipated, the Fine Spinner,' scheme has been defeated by the votes of the First Preferenc

(Continued on page 585)

FINANCE AND INN ESTMENT (Continued from page 584) holders who, in the opinion of virtually every competent judge, were being offered much less than justice. The board his now to decide whether to bring forward an amended plan or simply to leave things as they are until trade conditions improve. My own feeling is that a waiting policy is the wiser course. Conditions in the fine spinning section of the cotton industry are far from stable, and nobody can tell just yet whether we are heading for a genuine recovery in export trade.

Uncertainty both about the status of the shares in any amended scheme and about the company's earnings prospects has brought down Fine Spinners Et First Preferences from I is. to 8s. 9d. At this level these shares must surely be good value on a long view. Arrears of dividend date back over seven years to April, 1931, equivalent to roughly 371 per cent. gross, or about 5s. 9d. net per share, while it is obvious that when an amended scheme is produced, holders will have to be offered a fairly generous slice of the equity of the business. Anybody who buys the shares must be prepared to forgo income for some time, but should be compensated by an ultimate capital profit.

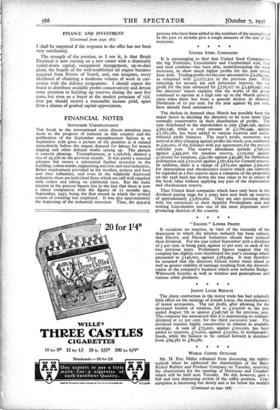

* * ROAD MAKERS' SHARE YIELDS

For the present, it seems, Great Britain is to go on rearming but some day there must be a halt. Either the world blows itself up or there must be an agreement to limit armament making. I will not try to guess at the schedule but it seems to me that there is a moral for investors. If arms limitation is on the way there must be a good time coming for road- building concerns, for how else is a harassed Government to fill in the gap than by embarking on the already-overdue road expansion programme ? I feel, therefore, that as long- term holdings, road makers' shares have a special attraction. Here is a representative group, with the yields at today's prices :

Yield on Current Last Dividend Price

s. d. £ s. d.

Limmer and Trinidad Li Ordinary

8z 6 3 8 6 Neuchatel Asphalte Li Ordinary

6 0 8 6 8 Ragusa Asphalte cos. Ordinary

57 6 to 0 0 George Wimpey Li Ordinary .. . • 75 0 5 6 8* * On cash dividend only.

The wide range of yields, between less than 31 and a full 10 per cent., is surprising at first glance. It is necessary to explain that Limmer and Trinidad Lake Asphalt is financially in a class apart from the others. It has a remarkably stable earnings record, has paid a 14 per cent. dividend in each of the past seven years, and has a reserve account, mostly invested in gilt-edged stocks, which more than covers the whole of its capital. This kind of balance-sheet strength has inevitably to be paid for in the price of the shares. Neuchatel and Ragusa both belong to the category of speculative invest- ments, and George Wimpey, as the yield implies, has a progressive record. Last year the 20 per cent. cash dividend was supplemented by a capital bonus of over 28 per cent., paid partly in new ordinary and partly in second preference shares.

* * *

Venturers' Corner

In discussing the implications of the Petters-John Brown- Brush Electrical deal a few weeks ago I drew attention to the merits of Brush Electrical 5s. ordinary shares as a lock-up speculation. The shares were then quoted around 5s. 3d. and are now slightly dearer at 5s. 71d., but in the meantime further evidence has become available of the company's steady progress. Works reorganisation is proceeding apace, the transfer of the Petters business should be completed within a few months, and the order book is in better shape than for many years past. To cope with a larger volume of business the board has offered 15o,000 new LI ordinaries at par, which will shortly be sub-divided into 5s. units, and (Continued on page 586) FINANCE AND INVESTMENT (Continued from page 585) I shall be surprised if the response to the offer has not been very satisfactory.

The strength of the position, as I see it, is that Brush Electrical is now starting on a new career with a drastically scaled-down capital, reorganised management, up-to-date plant, the benefit of the well-established oil engine business acquired from Petters of Yeovil, and, one imagines, every likelihood of obtaining a moderate volume of work in con- nexion with the defence programme. I should expect the board to distribute available profits conservatively and devote some attention to building up reserves during the next few years, but even so a buyer at the modest premium of 74d. over par should receive a reasonable income yield, apart from a chance of gradual capital appreciation.

Previous page

Previous page