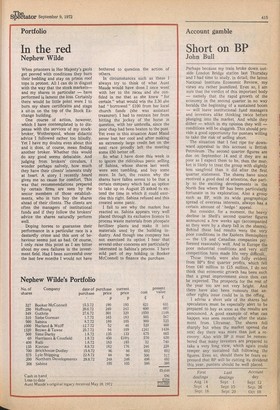

Account gamble

Short on BP

John Bull

Perhaps because my train broke down outside London Bridge station last Thursday and I had time to study, in detail, the latest National Institute Economic Review, my views are rather jaundiced. Eyen so, I am sure that the verdict of this important body — namely that the rapid growth of the economy in the second quarter in no way heralds the beginning of a sustained boom — will leave institutional fund managers and investors alike thinking twice before plunging into the market. And while they dither — which in my opinion they will — conditions will be sluggish. This should provide a good opportunity for punters willing to take the risk of selling short.

The situation that I feel ripe for downward appraisal in this account is British Petroleum. The second quarter figures are due on September 14 and if they are as poor as I expect them to be, then the market is likely to treat the group with slightly less sangfroid than it did after the first quarter statement. The shares have since received a good deal of attention, due partly to the exciting developments in the North Sea where BP has been particularly fortunate in its exploration. Also a group such as BP, with its wide geographical spread of overseas interests, always has a certain amount of ' hedge ' appeal.

But consider, for a moment, the heavy decline in Shell's second quarter figures announced a few weeks ago (accompanied as they were by a sharp fall in the shares). Behind these bad results were the very poor conditions in the Eastern Hemisphere

— the US and Canadian companies performed reasonably well. And in Europe the poor industrial conditions and very stiff competition have made life very difficult.

These trends were also fully evident from BP's first quarter profits, which fell from £40 million to £15 million, I do not think that economic growth has been such that a great improvement since then can be expected. The prospects for the rest of the year too are not very bright. And there have also been rumours that another rights issue could be in the offing.

I advise a short sale of the shares but speculators must be especially alert to be prepared to buy as soon as the results are announced. A good example of what can happen was seen recently after the statement from Ultramar. The shares fell sharply but when the market opened the next day there was more than just a recovery. Also with BP it must be remembered that many investors are prepared to take a very long view, which again could temper any sustained fall following the figures. Even so, should there be fears expressed that BP will be cutting its dividend this year, punters should be well placed.

Previous page

Previous page