Investment Notes

By CUSTOS

TliERE was a quiet opening to the new Stock Exchange account. Everyone is waiting for next Tuesday's announcement from to of the half-year's results. This creates a puzzle for the holders of the 61 per cent Convertible Loan Stock, now quoted at 1121. In December this stock is convertible on the basis of thirty-two shares for every one hundred of stock. At the present price of over 68s., this is equivalent to nearly 109. At the present time it would, therefore, pay the holder to sell and reinvest . in the Ordinary shares. Next year they will only be able to convert on the basis of thirty-one shares (Continued on page 365) .

per £100 stock. If the market estimate is correct and the half-yearly statement is good and the interim dividend raised, the shares will quickly move over 70s. And the whole market will follow up.

Colonial Loans

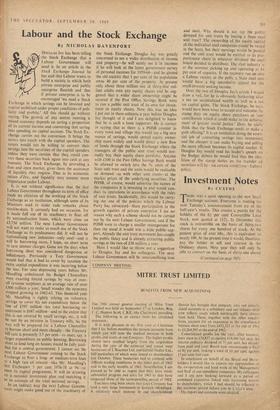

The small 61 per cent NI/warms Loan, 1973- 77, announced this week--with the attractive yields of £6 14s. 9d. per cent flat and £6 18s. 7d. per cent to redemption—calls atten- tion to the market •in colonial loans, which has recently enjoyed a substantial recovery.. As a well-known firm of brokers points out, the re, habilitation of the African bond market has, been striking. Some months ago buying developed in the RHODESIAN issues and this led to switching from these stocks into the much higher yield- ing EAST AFRICAN issues. Helped by Jomo Ken, yatta's more friendly tone to Europeans, these loans have made substantial gains in recent weeks, as the following table shows: 1.mv Price Prewar Plrn Ream:Mho,

1963 Price }7eld % }'irld % East African 51 1980/4 60 75 £7 1 0 £7 16 1 Federation 6%1976/79 ... 721 861 18 9 £7 14 I

Kenya 41% 1961/71 ... 671 82 £5 9 9 £7 19 3 Northern Rhodesia 41%,

1965/70 "' "• 78 86 £5 Nyasaland 41% 1971/78 53 691 £6 Southern Rhodesia 4% 1977/82. .. 591 721 £6 3 9 £7 2 9 Tanganyika 51% 1978/82 631 791 £7 5 I £7 18 5 These loans do not carry a British Government guarantee but most have inking funds which ensure repayment on the due date.

Amalgamated Metal

The shares of the AMALGAMATED METAL COR- PORATION have been rising in recent weeks on vague talk of a takeover. The company has some important shareholders, such as International Nickel, Consolidated Mining and the Banque Beige. There is a considerable European interest in the company, since it has a large holding in the Gdndrale des Mineris of Belgium and a 20 per cent holding in a German metal-refining com- pany. In the company's balance sheet the un- quoted stockS are valued at £3i million, which alone is equivalent to 17s. a share. Taking the

4 9 £7 8 3 9 6 £8 0 7

quoted investments at their end-1962 market values, the total assets are worth 40s. a share. The present market price is 38s. 6d., to yield 5.7 per cent on the 11 per cent dividend, which was only just covered last year when profits fell. As metal prices have been rising this year, trad- ing profits should be higher and the 11 per cent dividend should be better covered. In the absence of a bid from one of the European mining groups, the shares seem fairly valued, but a purchase might turn out well. especially if cnc of the big mining groups on the Continent decides to extend its holding in the company.

Previous page

Previous page