Company Notes

By LOTHBURY

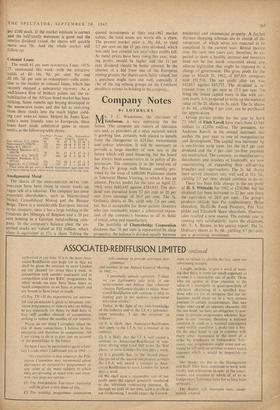

Ma, J. C. WILKINSON, the chairman of .Telefusion, is very optimistic for the future. The company are renters of television sets and, as providers of a relay network which is growing fast, certainly well placed to benefit from the changeover to 625-line transmission and colour television. It will be necessary to provide a large number of new sets in the future which will need financing, but the board has always been conservative in its policy of de- preciation. The company is in the forefront of the Pay-TV group with finance recently pro- vided by the issue of £480,000 Preference shares in Telemeter Home Viewing, in which it has an interest. Pre-tax profits for the year to April 27, 1963. were £685,647 against £584,845. The divi- dend was increased from 17 per cent to 20 per cent from earnings of 56.9 per cent. The 5s. Ordinary shares at 38s. yield only 2.6 per cent, but this is acceptable for those patient investors who can reasonably expect a substantial expan- sion of the company's business in all its fields of rental, relay and manufacture.

The portfolio of Charterbridge Corporation discloses that 70 per cent is represented by shop properties; the balance is divided equally between residential and commercial property. A further thirteen shopping schemes arc in course of de- velopment, of which seven are expected to be completed in the current year. Rental income over the next two years can, therefore, be ex- pected to show a healthy increase and investors need not be too much concerned about any adverse legislation that might be imposed by a change of government. The gross profit for the year to March 31, 1962, of £97,831 compares with £91,510. The net profit after tax was £42,015 against £45,777. The dividend is in- creased from 15 per cent to 17.5 per cent. To bring the issued capital more in line with cur- rent assets, it is proposed to write up the nominal value of the 2s. shares to 5s. each. The 2s. shares at 8s. 6d.. yielding 4 per cent, can be purchased for appreciation.

Group pre-tax profits for the year to April 27, 1963, of Fitch Lovell have risen from £1.949 million to £2.076 million. The president, Sir Ambrose Keevil, in his annual statement, de- scribes the past year as one of reorganisation and development. The capital was increased by a one-for-ten scrip issue, but the 16.5 per cent dividend and • the I per cent tax-free payment arc maintained. The company, as manufacturers. distributors and retailers of foodstuff's, are now concentrating on expanding their self-service branches and supermarkets. The 2s. 6d. shares have served investors very well and at 1 Is. 3d., yielding 3.9 per cent, should continue to do so.

There has been little change in the net profit of H. S. Whiteside for 1962 at £230,000, but the dividend has been increased to 22 per cent from the equivalent of 20.8 per cent. The group's products include Sun Pat confectionery, Helm chocolate, Be-Ze-Be Food Products, Pan Van pickle and Elizabeth Shaw chocolates. Overseas sales -reached a new record. The current year is running very satisfactorily, states the chairman, Mr. T. A. Barnes, in his annual report. The' 1 s. Ordinary shares at 4s. 6d., yielding 4.7 per cent, are a promising investment.

Previous page

Previous page