EUROPEAN FREE TRADE MIRAGE

By NICHOLAS DAVENPORT IT was fitting that Mr. Maudlin should have attended the recent OEEC dinner in Paris in a 'grey- blue' dinner jacket, for there is a half-tint to the whole colour of this European free trade negotiation. The six countries (West Germany, France, Belgium, Holland, Luxem- bourg and Italy) which have set up a common market were never really interested in a wider free trade area with the rest of Europe. France, moving from economic crisis to crisis, has always shuddered at the very thought of free trade. The reluctant 'Six' must have been tickled to death by the news that the Scandinavian bloc, with Finland, are to discuss setting up a common market on their own. This project could leave Great Britain more isolated than ever and if the European free trade area were to collapse—to the great delight of Lord Beaverbrook—we would have to fall back on the development of the Commonwealth markets, which take 50 per cent. or more of our

export trade. * *

However, the charm exerted by Mr. Maudling and his dinner jacket won' over the hearts of the hesitant Europeans. It has been finally decided to establish a European free trade area and, as soon as it is negotiated, to put it into practice without delay 'parallel with the Treaty of Rome.' Mr. Maudling is to be chairman of the negotiat- ing committee on which ministerial representa- tives of all the seventeen OEEC member countries will sit. Of course, he has had to make certain concessions. He has had to allow the discussion of agriculture's inclusion, although he has re-

served the right for Britain to maintain her agricultural tariffs and agreements if the others do decide on agricultural free trade. This seems to ensure that whatever happens the UK will co- operate closely with the common managed market in agricultural products, as far as its Common- wealth preferences and home farm subsidies will allow. But as regards industrial products we are now fully committed to European free trade. Within this area, where 25 per cent. of our export trade is concentrated, tariffs on manufactures will gradually be reduced—beginning perhaps next year—and eventually abolished. For good or ill British management and labour will have to face in future the tough competition of their European rivals. This may be saidsto complete the present Government's determination—or is it just Mr. Thorneycroft's?—to abandon the policy of domestic full employment.

Whether it will all work out as correctly as Mr. Maudling dresses for dinner is another matter. Personally I doubt it. The other week I was chiding Mr. Aneurin Bevan for being unreason- able—when he denounced European free trade as the return to the law of the jungle. The six countries which are setting up the common market believe very strongly in European political integration and economic. planning. They want to co-ordinate their economic policies and establish a supra-national authority (like the Coal, Iron and Steel Community) which will regulate production and marketing, remove all barriers to the free movement of capital and labour, ensure fair competition and provide transitional help to

industries in need. The 'Six' will not allow the establishment of a wider free trade area to weaken the cohesion of the common market. In fact, they insist that the common market must be treated as one unit in the free trade area. That being so I feel that the difficulties of marrying an nn" regulated free trade area, having different external tariffs, with a regulated common market having one common external tariff will increase rather than diminish the more the details of the opera" tion are examined.

For ourselves I fear an immediate increase in unemployment. It is clear that certain motor-cars can be made more cheaply in German or French factories than in Coventry or Birmingham. AS British capital and labour cannot emigrate, there are bound to be idle labour and idle resources in Coventry and Birmingham, and it is quite imPo -s sible to say that they will be absorbed in other areas which may have gained from European free trade. If the unemployment grew out of control we should be forced eventually to reimpose imPort quotas. In fact, it might be found that currencies which are in exchange equilibrium under a system of tariffs would be pushed out of equilibrium under a system of European free trade.

* * *

It is extraordinary that in all these European discussions no committee has yet been set up to examine the payments problem. It is on balance' of-payments crises that the European free trade area is most likely to founder. Clearly the existing EPU system, which requires settlement of deficits up to 75 per cent. in gold, is much too dangerous. A lowering of the gold requirement to 25 per cent. would be desirable. And is an authority to be set up to see that countries continually in surplus inflate and countries continually in defied deflate? Are all the free-trade area nations pre' pared to hand over national sovereignty in domestic economic matters as Mr. Thorneycroft seems to be? If not, how are the payments prob- lems to be settled? Are exchange rates to be allowed to float? The UK has a special payments difficulty because it is settling for the whole of the sterling area and has an insufficiency of gold. and dollar reserves to begin with. These payments problems may convince many countries before long that the maintenance of domestic full employment is really more important than Eur°' pean free trade.

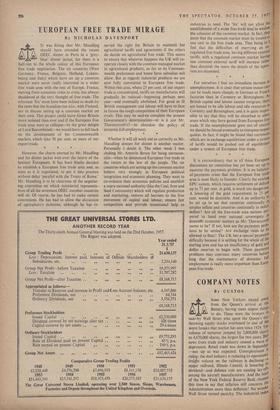

Previous page

Previous page