COMPANY NOTES

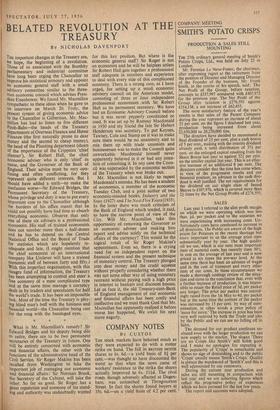

By CUSTOS THE stock markets have behaved much as they were expected to do with amotor strike on hand. The fall in BRITISH MOTOR shares to 6s. 6d.—a yield basis of 81 per cent.—was thought to have discounted the worst so that when the news came of workers' resistance to the strike the shares actually improved to 6s. 114d. The rival FORD. though adversely affected at Dagen- ham, was untouched in Throgmorton Street. In fact the shares found buyers at 35s. 6d.—on a yield basis of 4.2 per cent.

The strike naturally caused some profit- taking, a lowering of prices and a drying-up of business but it was fears of President Eisenhower's health and of Wall Street's reaction which brought a substantial set- back in the leading oil shares. The only market which acted contrary to expecta- tions was the gilt-edged which did not like the announcement of a new £5 million Agricultural 5 per cent. loan 1979-83 at 97. Just when some recovery was due to follow the successful funding of the £824 million of National War Bonds the reopening of the new issue lists plunged the market into gloom.

The present reaction in the industrial share markets is the time for wise investors to pick up the best 'growth' shares. There is a significant demand for HEAD WRIGHT- SON which have jumped 6s. to 5196. This is a unique 'growth' share for the company makes the plant for the big 'growth' industries—oil, steel and engineering—and has linked up with the important Reyrolle- Parsons nuclear power group. The yield is low on the present 20 per cent. dividend— about 3+ per cent.—but earnings were last reported at 70 per cent, and the 1955 high for the shares was 6f. I notice that ENGLISH ELECTRIC are firm at 54s. Here is a'growth' share with a not unattractive yield of 4.6 per cent. But the highest yield offered by the 'growth' shares in my select list is COURTAULDS which at 36s. 6d. returns 5+ per cent., the 10 per cent. dividend being covered 3.3 times by the last reported earnings.

Consideration of the full accounts justifies the inclusion of ASSOCIATED PORT- LAND CEMENT in any 'growth' list but the shares came back this week to 101s. It is worth noting that over the past ten years capital expenditure, which has been financed entirely without the issue of fresh share capital, has amounted to nearly £32 million. The trading profits have grown from £3.7 million to £13 million and the net profit from £1 million to £4.6 million (down from £5 million in 1954, because of the rise in costs). Overseas trade is now the important factor, for only about 30 per cent, of the group's profit before tax is earned from deliveries to the home market. The revaluation of Ahe fixed assets at £42.8 million put up a surplus of £17.8 million for the reserves and the company is distributing three bonus shares for every two. This carries, of course, no promise of a higher distribution. Last year earnings were over 98 per cent, and the dividend was 221 per cent. The equivalent dividend on the increased capital would be 9 per cent,, but it is not unreasonable to go for 10 per cent. With the shares at 101s. cum bonus the yield on this basis would be nearly 5 per cent.

Previous page

Previous page