Banking in 1927

An Abnormal Year—Deposits Higher—Trade Demands

DOUBTLESS the moment will at some time arrive when; in surveying the Banking developments over the preceding twelve months, it will be possible to describe the year as having been a " normal " one. It may be doubted, howeVer, whether that moment will arrive for a considerable time to come. Nor, needless to say, is the explanation of that fact to be found in our banking system or in banking methods, but rather in those ' external conditions - which affect every part of the country's well-being. - . it is interesting sometimes to speculate on the extent to which present post-War problems would have been simplified if the conflict, even if it had lasted for four years, had ended with the defeat of Germany and with the status quo of all other countries preserved. Experience has shown that the lasting character of the effects of the war upheaval has-been due not merely to the financial losses sustained, but to the radical changes, not only in national and physical, but in financial boundaries. The changes which* haire taken -place in the mai). of .Europe; and especially the great upheaval in Russia, largely account for the slowness of the fiscal revival in EnrOpe-, especially when joined to the actual financial losses suffered. Equally disturbing, . hi:ovrever, to the general equilibrium is the fact that the four Yews' war added so greatly to the prosperity and 'Strength of one particular country-the United States -=and that fact is mentioned, not in any spirit of envy, but simply because the', change in the position of that country from a debtor to a creditor nation has had so great an effect in 'complicating the problems of international finance, and especially of the foreign exchanges. '

SLOW RECUPERATION.

In this country, moreover, return to the normal has also been hindered by. many local disturbances. from time to time, and in our Financial Supplement of a year ago we had to refer to the year 1926 having been a wholly abnormal one by reason of the disturbances occasioned by the General Strike and the prolonged coal stoppage. The past year has, in a sense, been one of financiaL recuperation, with a return in some respects , to, more norinalconditions. Indeed, if bankera themselves were asked to speak on the Matter,. they would probably. say.that the year .1927 had; on the whole, been _quite as good as could possibly have been expected, having regard to the events of 1926. There were some, of course, who at the end of that year lightheartedly prophesied an immediate return to prosperity with the reanirirition. of the .coal output. It was the same after the'Greitt' War; when some considered that as soon as the fast 'atiot. was fired a veritable boom must begin in 'English trade. - -And in both instances it is not difficult to . follow- the"'argument from the standpoint of the mere superficial observer. • it is quite true that after the four yearS' war all -countries were clamouring for goods of various kind;s, and, similarly, after the cessation of thee-actual Stoppage; it was assumed that arrears of orders Were such, and stocks themselves in many instances were so lciwi that large orders must instantly come -to hand. Bankers, however, who were called upon to handle thadifficult situation_ during the War and during the period of the coal stoppage, knew perfectly well that the passing of time-would only serve to reveal the extent. of the damage inflicted by the previous upheaval, and probably most bankers expected to find that the first half of 1927 would be a difficult one. In this they were not mistaken. So far as the key industries of the country were concerned, each, succeeding annual report of big concerns,--hke railways, coal, iron and steel companies showed in graphic fashion'tlit_ fatal Conseqnences of the previous year's upheaval. From the standpoint of bankers' profits, as we shall see later, the depression in these leading industries, was offset to some extent by the activity and prosperity of 'some of the newer industries, such as artificial silk, Motor mannfacturing, etc., while financial activity, .: as expressed in new loan flotations, and a general upward movement in Stock Exchange 'securities, were features throughout the year. So far as the " Big Five "-; are concerned, it may, be said that, these offsetting influences were .Sulficiently powerful to very largely counteract the effect of the depression in certain trades, but in the case of some of the provincial institutions, and not least, those connected with the cotton industry, the ,yisar4i:eulit have been a difficult one, though a good featnra atr.3*,end of .the year was they better tendency displayed in iron and steel. , - - MAIN FEATURES SUMMARIZED.

If the main features of the year, and more especially/ those ditectirliffecting_ Banking business, were to be summarized, they might` perhaps fairly be iiiiimericed somewhat in the following order : (1) After-effects of the coal stoppage ; (2) Concentration-of interest during the greater:part of-theyear on financial, rather than industrial activities ; (8) An improvement ..in industrial- actiyity towards the end of the year ; (4) Greater Steadiness in the Foreign Exchanges and.a slight downward tendency in the value of money ; (5) A further measure of deflation, following upon the 'repayment of a 'large amount by the Bank of France to the Bank of England ; and (6) Greater steadiness in money rates, as a whole believed to be due •Uart_ to co-operation between the Central banking iitiona 'forCW especially befwien • the Federal Reserve Bank in the United States and the Banks of France and Germany and the Bank of England. It may be interesting to see how far these main features are reflected in the balance-sheets- of the various Banks.

RISE IN DEPOSITS:

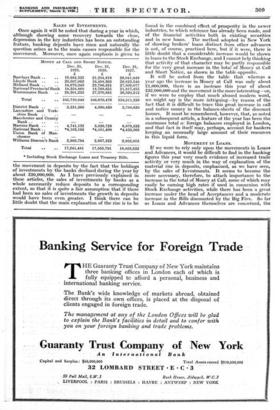

Two years ago the Banking Deposits were showing a retrograde tendency, following upon the expansions -connected with the War and post-War inflation period. A year ago, however, there was an increase in the deposits of the Big Five of about £50,000,000, and this year there is a further expansion of about £37,000,000, making Within the two years a growth of nearly 1100,009,000. In the case of the Provincial Banks, however, there was a general decline during 1926, and it is satisfactory to know that nearly the whole of this-has been recovered during the past year, so that taking the principal country banking institutions as well as the figure's- of the Big Five, the increase in deposits for the past twelve months is about £43,000,000, while the cash as shown in the table below has risen more than proportionately, the percentage in the case of the " Big Five " being' 13 per cent. against 12'8 per cent., while the proportion shown by the Pro- vincial Banks cias risen from 14.2 per cent. to 15'2 per cent.

DErosrrs.

Dec. 31, 1925. £ 306,259,816 337,178,515 348,682,134 252,737,817 271,379,667

Dec. 31,

1926.

£ 309,883,691 346,132,523- 366,423,103 259,249,807 285,406,068 Dec. 31,

1927.

2' 1 318,373,472 357,184,897 374,375,146 273,597,202 280,-612,020

Barclays Bank Lloyds Bank ..

Midland Bank.. .. National Prov. Westminster Bank ..

Total ..

District Bank .. .. .. 14.8 14.9 115.3

Lancashire and Yorkshire Bank .. 20.9 21.7 -21.6 Manchester mid _County Bank.. . . 19.7 19.7 _20 • 3

Martms Bank .. 12 . 1 10.0 11.$ National Bank .. .. 10.9 10.9 Ll • 0 Union Bank of Manchester 14.2 20.0 '25.7

Williams Deacon's Bank .. 12.4 12.7 13 .0?

' Total .. • -----.': --14''2--- -T4:2' - -15.2

Total .. 247,514,490

Casa Ix HAND AND AT Balm

Dec. 31, 1925.

Barclays Bank .. 45,672,882 Lloyds Bank : .. 39,401,271 Midland Bank .. .. 53,590,604 National Provincial Bank 28,472,434 Westminster Bank .. 31,687,095 District Bank Lancashire and York- shire Bank .. . Manchester and County Bank Martins Bank National Bank Union Bank of Man- chester Williams Deacon's Bank 64,050,540 24,990,776 20,211,047 , 59,819,627 37,371,727 18,283,110 32,787,663 Total .. • . 198,824;286 201,331,626 208,147,89d

District Bank .. .. 7,997,847 7,791,947 8,246,430 Lancashire and York- shire Bank . . Vanchester. and County

Bank *3,978,857 *3,782,687 *3,900,360. - Martins Bank .. 7,252,886 5,961,008 7,3_94,983 National Bank .. 4,072,378 4,023,990 4,023,894 Union Bank of Man- chester .. *2,608,341 *3,478,419 *4,551,541

Williams Deacon's Bank 4,071,011 4,117,835 4,133,254k

Total • .. 35,193,123 34,291,053 37;548,060 * Including money at call and short notice: *5,211,803 *5,135,167 *5,197,594 c.

OF CASH IN HAND AND AT BANK Darosrrs.

Dec. 31, 1925.

• • auk Dec. 31, 1926.

14.6 12.4 14 5 11.0 11.1 .. 13.1 12.8 OF ENGLAND TO Dec. 31il ;1927. 0/0 i15.6 12-6 13.3 11.7 114

13.9 PROPORTION Barclays Bank .. Lloyds Banli - . . Midland Bank .. National Provincial B Westminster Bank ..

Total .. .. 1,516,237,949 1,567,095,192 1,604,142,737 02,321,532 53,721,367 • 23,500,581 24,026,215 19,248,593 19,178,500 59,819,326 62,890,872 36,814,913 36,577,997 17,434,522 17,734,302 32,438,363

32,662,567

241,737,830' 246,791,820 OF ENGLAND.

Dec. 31, 1926.

45,105,729 42,998,320 52,994,044 28,528,200 31,705,333 Dec. 31, 1927.

49,564,180 45,155,865 49,763,778 32,078,96i 31,585,106

SALES OF INVESTMENTS.

Once again it will be noted that-during a year in which, although showing some recovery towards the close, depression in the key industries has been an outstanding feature, banking deposits have risen and naturally the question arises as to the main causes responsible for the movement. Moreover, once again emphasis is given to

MONEY AT Barclays Bank ..

Lloyds Bank .. Midland Bank National Provincial Bank Westminster Bank .. CALL AND SHORT NOTICE.

Dec. 31, Dec. 31, 1925. 1926.

£ 19,864,335 21,284,818 20,507,062 16,458,305 18,679,349 22,786,851 18,358,868 18,769,651 28,301,235 27,370,851 Dec. 31, 1927.

26,041,049 26,623,546 27,509,077 21,817,455 36,520,212 Total • • .. 105,710,849 106,670,476 138,511,339 District Bank .. . . 5,331,360 4,590,420 5,786,620 Lancashire and York- shire Bank .. . .

Manchester and County

Bank ..

Martins Bank .. 4,741,132 - 5,826,728 6,679,533 National Bank .. *4,183,195 *4,181,400 *4,433,565 Union Bank of Man- chester

Williams Deacon's Bank 2,985,794 2,957,233 2,952,915 Total .. 17,241,481 17,555,781 19,852,633 * Including Stock Exchange Loans and Treasury Bills.

the movement in deposits by the fact that the holdings of investments by the banks declined during the year by about £20,000,000. As I have previously explained in these articles, the sales of investments by banks as a whole necessarily reduce deposits to a corresponding extent, so that it is quite a fair assumption that if there had been no sales of investments the growth in deposits would have been even greater. I think there can be little doubt that the main explanation of the rise is to be found in the combined effect of prosperity in the newer industries, to which reference has already been made, and of the financial activities both in existing securities and in new loans. The method adopted in New York of showing brokers' loans distinct from other advances is not, of course, practised here, but if it were, there is little doubt that a considerable increase would be shown in loans to the Stock Exchange, and I cannot help thinking that activity of that character may be partly responsible for the very great increase in the total of Money at Call and Short Notice, as shown in the table opposite. It will be noted from the table that whereas a year ago the increase in Money at Call was only about £1,000,000, there is an increase this year of about £32,000,000 and the movement is the more interesting—or, if we were to employ that much abused modern word, we might say is the more intriguing—by reason of the fact that it is difficult to trace this great increase in call and notice money in the balance-sheets of the discount houses. It must be remembered, however, that, as noted in a subsequent article, a feature of the year has been the enormous total 01 foreign balances employed in London, and that fact in itself may, perhaps, account for bankers keeping an unusually large amount of their resources in this liquid form.

MOVEMENT IN LOANS.

If we were to rely only upon the movements in Loans and Advances, it would be difficult to find in the banking figures this year very much evidence of increased trade activity or very much in the way of explanation of the material rise in deposits, emphasized, as we have seen, by the sales of Investments. It seems to become the more necessary, therefore, to attach importance to the increase in the total of Money at Call, some of which may easily be earning high rates if used in connexion with Stock Exchange activities, while there has been a great increase under the head of Acceptances and a moderate increase in the Bills discounted by the Big Five. So far as Loans and Advances themselves are concerned, the increase for the year is only about £5,000,000 as compared with an advance of over £40,000,000 in the preceding year, but, on the other hand, Acceptances and Endorse- ments, which last year dropped about £10,000,000, have risen this year, so far as the Big Five are concerned, by no less than £31,000,000, while the total of Bills discounted increased by nearly £4,000,000. The detailS are as follows :—

LOANS AND ADVANCES.

Dec. 31, Dec. 31, 1925. 1926.

£ £ Barclays Bank .. 153,028,485 155,454,795 Lloyds Bank 183,330,726 194,757,519 Midland Bank 196,747,548 200,459,993 National Provincial Bank 133,617,259 142,190,250 Westminster Bank .. 126,516451 141,741,479 Total .. 793,240,069 834,604,036 District Bank .. .. 25,555,233 24,188,792 Lancashire and York- shire Bank .. 10,672,495 9,900,512 Manchester and County Bank .. .. 13,017,569 12,464,118 Martins Bank .. .. 35,413,244 36,702,937

National Bank .. .. 16,321,759 15,903,430 Union Bank of Man-

chester .. 13,047,953 11,548,019 Williams Deacon's Bank.. 18,295,020 18,984,829 Total .. 132,323,273 129,692,637 128,254,542 ACCEPTANCES ENDORS EMENTS, &C.

Dec. 31, Dec. 31, Dec. 31, 1925. 1926. 1927.

£ £ Barclays Bank .. .. 17,175,922 12,446,160 12,830,669

20,686,775 16,950,606 f *5,952,940 11'37,815, 6 37,065,445 36,997,594 35,747,790

9,166,822 12,024,760 10,025,151 11,543,630 12,572,869 13,562,790 Total .. 97,198,428 87,172,663 118,194,008 District Bank .. 2,035,112 890,450 1,029,527

tanc-aiihire and York- shire Bank 135,948 143,578 119,689 Manchester and County

Bank .. 574,419 337,857 305,850 6,618,372 6,078,122 6,389,255 Martins Bank .. 100,000 103,280 - National Bank ..

Union Bank of Man-

917,857 818,391 643,163 chester 2,359,452 1,800,918 1,393,259 Williams Deacon's Bank

.. 12,741,160 10,181,596 9,880,742 t -PAndorsements, guarantees and other obliga-

BILLS DISCOUNTED.

Dec. 31, Dec. 31, 1925. 1926.

Barclays Bank 32,028,847

Lloyds Bank .. 41,624,130

Midland Bank .. 41,888,022 National Provincial Bank 35,880,917 Westminster Bank .. 39,999,504 Total .. .. 191,421,420 206,051,625 209,714,660 District Bank 4,101,395 4,768,582 3,402,174 Lancashire and York- shire Bank .. .. 3,217,326 3,228,317 3,221,102

Manchester and County 1,071,559 865,833 771,310

Martins Bank .. 4,315,722 2,981,479 2,646,294 National Bank 2,700,596 2,535,048 2,329,697

Union Bank of Man-

, chester 1,010,940 754,596

Williams Deacon's Bank 3,713,382 2,440,903

Total .. .. 20,130,920 17,574,758 15,613,434

FALL IN INVESTMENTS.

When considering the movements in the total of rong-dated securities held by the banks, it is impossible Dec. 31, 1927_ £ 161,867,906 187,798,225 206,487,910 146,715,210 137,054,470

839,923,721 25,120,405 10,039,268 12,132,317 36,572,971 15,359,400 10,780,258 18,249,923 Lloyds Bank ..

Midland Bank National Provincial Bank Westminster Bank ..

Total ..

* Acceptances. tiers. 36,617,279 47,182,971 46,744,312 35,100,607 40,406,456

Dec. 31, 1927. £ 32,518,234 52,048,834 49,314,778 38,993,472 36,839,342

743,228 2,499,629

not to be impressed with the maga.; e of the sales and the small effect produced upon prices of the stocks. In 1923 there was a fall in the total holding of investments by the Big Five of about £90,000,000, in 1924 the total fell by £47,000,000 and in 1925 there was a drop of about £37,000,000, while in 1926 there was a further decline of 110;000,000. Now during the past year there is a further shrinkage of about £20,000,000, so that during the past five years there has been a total decline in the holding of investments by-the Big Five of about £204,000,000. Yet, in -spite of that fact, and in spite of large flotations of new capital, we know that prices of British Funds and kindred securities have not only held their own but have actually risen during the period under review. It is a rather remarkable situation and somewhat suggestive of greater forces operating than those merely expressed by a diversion of capital from leading key industries to activity in Stock Exchange securities. Nor must the fact be overlooked that most, if not all of these sales have been effected at prices profitable to the selling banks and, indeed, there is little doubt that profits from such sales have gone far to offset losses occasioned by the banks in connexion with bad debts.

INVESTMENTS.

Dec. 31, Dec. 31, 1925. 1926.

Barclays Bank 59,596,214 56,259,936

Lloyds Bank 53,722,653 46,455,051 Midland Bank ..

National Provincial Bank 34,791,276 38,964,003 38,853,582 36,947,304 Westminster Bank .. 46,938,525 45,867,674

Total .. .. 234,012,671 224,383,547 204,373,483

District Bank .. .. 14,565,211 14,544,836 14,793,704

Lancashire and York-

shire Bank.. ... 7,719,123 7,590,658 7,580,590 Manchester and County

Bank .. .. .. 4,065,897 4,065,897 4,215,897 Martins Bank .. .. 8,677,097 9,349,216 10,421,735 National Bank ... . 15,435,845 15,453,589 15,552,527 Union Bank of Man- chester chatter .. .. 2,659,160 2,670,101 2,664,208

Williams Deacon's Bank 4,745,249 5,049,670 5,284,671

Total .. 57,867,582 58,723,967 60,513,332

NorE.—These figures do not include investments in affiliated banks.

BANKERS AND INDUSTRY.

There is One point connected with the foregoing figures which may possibly be suggestive of improvement in a direction where, undoubtedly, improvement was needed. I do not think there is any doubt that the general demand for banking accommodation, including overdrafts, must have been fully as great, if not greater, than in the preceding year, and yet there is not the same direct evidence in the total of loans and advances. Doubt- less in some industries where trade has been particularly depressed, fresh advances may have been brought to a standstill, but it is also not at all improbable that one of the effects of trade improvement is to be found in repayments of old outstanding loans, or what is sometimes described as the liquefying of frozen credits. This is a point to which a leading banker recently drew attention in the course of a discussion at the Bankers' Institute when, in considering the question of the power of bankers to finance any trade revival, having regard to the already high proportion of loans to deposits, it was pointed out that past experience showed that not infrequently a trade revival was accompanied either by a very small expansion in loans or sometimes even by a slight reduction owing to the fact that many who were helped during the period of trade depression by bankers' loans were able, when the revival came, to effect repayment. Dec. 31, 1927. £ 53,389,700 39,936,888 35,435,530 35,578,615 40,032,750

ARTHUR W. KIDDY.

Previous page

Previous page