"What is Left"

Some Insurance Considerations

" IF one attempted to provide by insurance against the majority of ills to which one _ is heir, there would-be nothing left to live on," is the view taken by many folk with responsibilitieS which they do not wish to face squarely. This view again leads to a tendency to minimize or practically ignore any provision against risks of any-kind, or at least to remain content with but a partial _security. Many an executor must think a good deal more than for charitable reasons he dare to express when he discovers that the friend for whom- he is acting has valued the welfare of his wife and family at a less sum thin lie could have secured for them for £1 or so per week.

There is no doubt that to some degree it is the impor- tunity of agents and others not over-diplomatic in utterance or presentation that pita men off insurance,_ together with a certain hesitancy as to *hat to do and how to do it to the best advantage.

LEAVING IT TO POSTERITY.

Further there is the instinct, probably too national in our own case, of leaving posterity to bear its own burdens, pleading that " marginal income." nowadays does not exist, although many persons with this view are able to discover some marginal income for purposes of personal satisfaction. However, whether this is so Or not, the problem of ascertaining " what is left," if one 'does take a rational view of one's present and future' obligations, is an interesting one. One may take the case of a married man, aged forty, with £1,000 a year, -• with two boys, aged five and seven next birthday, and assume that he carries no insurance but can be persuaded to expend £100-per annum in this direction.

SOME PRACTICAL SUGGESTIONS.

An infinite number of suggestions could be put before such a man, according to his social status and the view he- __takes of life.

It is fairly obvious that the first essential is to get a fairly large cover against early death in the form of either a &tali. sum ddviri or income for a definite period to tide over the obligations which will fall upon his wife in such an event. Whilst endeavouring to do the best in this direction one should not lose sight of the probability of surviving to a period *hen' the necessity for insurance against death is not so acute and gives place to the need for a pension. Having made good this provisiiin, there is then the risk which often arises of a prolonged illness, which might not only prejudice income but also make it difficult to maintain the Life l'olicjr. • • '7 " ' PROVISION FOR ILLNESS.- The middle class and professional man is for the most part ignored by our beneficent State in so far as insurance benefits are concerned; which are more or less restricted to persons with less than £250 a year income, so that much help from this source, if any, is not available, The need, _therefore ;: arises for an 'income policy-:payable during any sickness or accident over the working period of life. In the case of short illness it is often possible to tide over increased expenditure;' and with the class of man we are considering it is really illnesses of more thah three months' duration which. will prejudice his incur)* and give him anxiety. , It is noteworthy that Permanent Sickness Policies, where the insured bears the cost of _illness ,for the _fill few -weekS of illness, can be obtained 'at remarkably low rates.

Hiving thus made provision for"Life, .SicleneWand Accident, the suggested expenditure of '£100 'per 'Minna' will still permit of provision for the boys aged five and seven, and one of the best forms of such provision is a Children's Deferred Assurance, which not only secures a Life Assurance commencing from age twenty-one, but offers as an alternative an EndoWnierit at. twentjr...one. Such a policy can be utilized, if necessary,, towards educational expense prior to that -date.

One of the peculiar- advantages of this policy is that on a child reaching the age of twenty-one,, ,whatever state of health or occupation he may then be in, he holds a Life Policy on his own life which' he can maintain at premium of practically- fifty per cent, of the cost of insurance if left over until age twenty4ne: Now the cost of all these benefits to the man we are considering, aged forty, works out at just over £100 per annum, but against this the Government rebate from Income Tax in respect of the Life Policy (at present ten per cent. on the Life premium) would bring the cost down to under £100 and sufficiently under to provide a margin for Fire Insurance on one's property.

It will thus be seen that a modest charge of ten per cent. on an income of £1,000 per annum will in the ease of a healthy man aged forty provide for most of the physical risks which would involve loss of income, and it of course follows--that for a person younger than forty or for one who has foreseen his responsibilities by effecting Life Policies earlier in life, the annual cost would be 'considerably less.

BENEFITS SUMMARIZED.

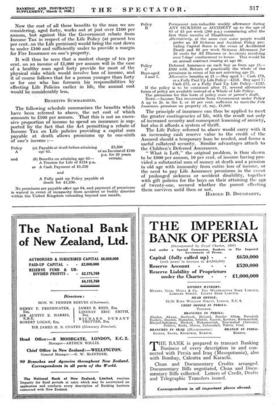

The following schedule summarizes the benefits which have been referred to above, the net cost of which amounts to £100 per annum. That this is not an exces- sive proportion of income to spend on insurance is sup- ported by the fact that the Act permitting a rebate of Income Tax on Life policies providing a capital sum payable at death allows premiums up to one-sixth of one's income :—

Policy (a) Payable at death before attaining £2,500 A age 65. or an Income of £160 p.a. for 20 years and (b) Benefits on attaining age 65— certain. A Pension for Life of £124 p.a.

or A Cash Payment of £1,250 and A Fully paid up Policy payable at death for £1,250.

No premiums are payable after age 64, and payment of premiums is waived in event of incapacity from accident or bodily disorder within the United Kingdom extending beyond one month. Policy Permanent non-reducible weekly allowance during

B ANY SICKNESS or ACCIDENT up to the age of

65 of £5 per week (260 p.a.) commencing after the first three months of Disablement.

Alternatively, at the same cost some people would prefer an All Sickness and Accident Policy pro- viding Capital Sums in the event of Accidental Death and £6 per week Sickness Allowance for 26 weeks for All Illnesses or Accidents involving over 7 days' confinement to house. This would be an annual contract ceasing at age 60.

Policy Deferred Assurance on each boy as from age 21- C £500 with Return of practically the whole of the

Boys aged premiums in event of his not surviving age 21.

5 and 7. Alternative benefits at 21 :—Boy aged 5 : Cash £78, or a Fully Paid Up Life Policy—£253. Boy aged 7 : Cash £72, or a Fully Paid Up Life Policy—£232. If the policy is to be continued after 21, several alternative forms of policy are available instead ef a Whole of Life Policy. The premiums for this form of policy cease at parent's death. NOTE.—Income Tax recoverable from Government under Policy A up to 2s. in the £, or 10 per cent. sufficient to meet the Fire Insurance premium on property of, say, £1,000.

The principle of insurance can thus be applied to meet the greater contingencies of life, with the result not only of increased security and -consequent lessening of anxiety, but also it affords a system of thrift.

The Life Policy referred to above would carry with it an increasing cash reserve value to the credit Gf the Assured should a temporary loan be needed, and forms a useful collateral security. Similar advantages attach to the Children's Deferred Assurances.

" What is Left," the original problem, is thus shown to be £900 per annum, 10 per cent, of income having pro- vided a substantial sum of money at death and a pension in old age with immunity from entire loss of income, or the need to pay Life Assurance premiums in the event of prolonged sickness or accident disability, together with gift policies for the boys on their attaining the age of twenty-one, secured whether the parent effecting them survives until then or not.

HAROLD D. DOUGHARTY,

Previous page

Previous page